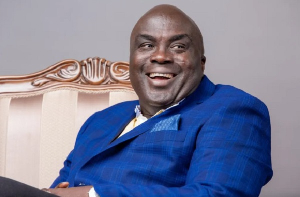

Nigerian billionaire Femi Otedola is one of the many shareholders in Nigeria’s oldest bank, First Bank of Nigeria Holdings Plc (FBNH), who have seen their net worth increase significantly in recent weeks as a result of the rise in the share price of the financial services group.

According to data tracked by Billionaires.Africa, Otedola, who made his fortune through his shipping and energy businesses, has seen the market value of his equity stake in FBNH rise by $8.3 million in the past 29 days due to a sharp rebound in the bank’s share price.

FBN Holdings is one of Nigeria’s largest financial services conglomerates. It is the holding company for First Bank of Nigeria Limited, the country’s oldest commercial bank, with operations in 10 countries.

Otedola, a prominent energy tycoon who recently listed his power-generating business, Geregu Power Plc, on the Nigerian Exchange, is the largest shareholder in FBNH with a sizable stake of 5.57 percent.

The share price of FBNH has increased by 20.3 percent since Oct. 27, from N9.1 ($0.0205) per share to N10.95 ($0.0247) as of the time this report was being written, according to data retrieved from the Nigerian Exchange.

As a result of the double-digit surge in the company’s shares, the market value of Otedola’s stake has increased from N18.2 billion ($41.05 million) to N21.9 billion ($49.4 million), marking a gain of N3.7 billion ($8.34 million) for the Nigerian billionaire.

The increase in the company’s share price that resulted in the gains for Otedola and other FBNH shareholders can be attributed to investor reactionss to the company’s financial performance at the end of the first nine months of the current fiscal year.

Figures contained in the group’s recently published financial result revealed that its profit more than doubled during the first nine months of its current fiscal year, from N40.9 billion ($93.4 million) to N91.29 billion ($208.8 million), as the leading financial services company leveraged its well-diversified loan portfolio.

With the recent increase in FBNH earnings, Otedola, who received a dividend of N951.05 million ($2.29 million) from his stake in the top performing financial services group, is on track to receive another substantial dividend in 2023, as investors anticipate directors declaring higher dividends at the end of this year.

Click to view details

Business News of Sunday, 27 November 2022

Source: billionaires.africa