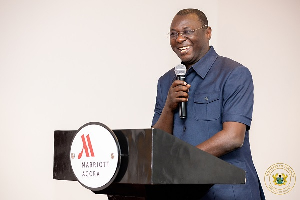

Finance minister Dr. Mohammed Amin Adam has called on banks to play a pivotal role in the country’s economic recovery.

Addressing key financial sector stakeholders ahead of the 2024 mid-year budget review, Dr. Adam emphasised the critical juncture at which Ghana’s economy stands.

“Our economy is at a pivotal juncture, and it is imperative that we work together to ensure sustainable growth and prosperity for all,” he stated, highlighting the Ghanaian economy’s resilience in the face of recent challenges.

The minister pointed to encouraging signs of recovery, noting that the economy grew by 2.9 percent last year – surpassing initial projections of 1.5 percent. He further revealed that the first quarter of 2024 saw a robust growth of 4.7 percent, the highest first-quarter growth since 2020.

Central to government’s growth strategy is a renewed focus on Small and Medium Enterprises (SMEs). He announced the SME Growth and Opportunity Programme’s imminent launch, set for July 16th.

“We envision SMEs being the cornerstone of our economic renaissance,” he said, underlining the sector’s significance in job creation and manufacturing.

The programme aims to address key challenges faced by SMEs, including access to finance and markets.

The Development Bank Ghana is poised to channel approximately GH¢1.4billion through participating financial institutions to support viable SMEs.

Additionally, the International Finance Corporation (IFC) is structuring a US$400million package to complement this initiative.

Dr. Adam stressed the indispensable role of banks in this grand plan, saying: “The banks will have to provide financing to the private sector. Government is not able to take as much external credit as we could because we want to achieve our debt sustainability levels, and so the banks will have to come in and play that critical role”.

The minister also highlighted positive trends in the banking sector, citing the Bank of Ghana’s latest Monetary Policy Committee report. Total assets increased by 28.8 percent to GH¢306.8billion at the end of April 2024, with banks reporting higher profits compared to the same period in 2023.

Dr. Adam emphasised government’s commitment to creating an enabling environment for banks to thrive.

“We want to rally the banks’ support, especially at this stage in our economic development,” he stated, acknowledging the sector’s contribution to economic recovery.

The finance minister also touched on government’s efforts to restore macroeconomic stability, mentioning the recently concluded debt restructuring.

“Macro stability is returning to the economy, we’ve concluded our debt restructuring. Going forward, we want to focus on growth,” he noted.

However, Dr. Adam cautioned about the challenges ahead – citing historical precedents when countries undergoing debt restructuring struggled to exceed 1 percent growth. He stressed the need for intentional growth strategies, particularly in light of ongoing fiscal consolidation under the IMF programme.

Business News of Monday, 15 July 2024

Source: thebftonline.com