In October 2019, Absa Group in partnership with Official Monetary Financial Institutions Forum (OMFIF) launched the “Absa Africa Financial Markets Index 2019”. The Index evaluates financial market development in 20 African countries and highlights economies with the clearest growth prospects.

The 20 countries are in the following regions-West Africa (Ghana, Nigeria, Cote d’Ivoire, Senegal and Cameroon); East Africa (Kenya, Ethiopia, Seychelles, Mauritius, Tanzania, Rwanda and Uganda); Southern Africa (Namibia, Botswana, Zambia, Mozambique, and South Africa); North Africa (Egypt and Morocco) and Angola in Central Africa.

The current Index is the third since 2017 when it was first launched by Barclays Africa Group ((now ABSA Group Limited). It analyses economies’ present positions and how they can improve market frameworks to meet yardsticks for investor access and sustainable growth. Dr Maxwell Opoku-Afari, first Deputy Governor, Bank of Ghana, was the keynote speaker at this year’s launch in Washington, DC. That aside, this script considers it worthwhile to share with you the six (6) fundamental pillars upon which the Index was developed. To note, the 20 countries had different scores in terms of the key indicators under each of the six pillars. This script will, however, highlight some of the key findings on Ghana’s capital market as contained in the 40-page Index. Let’s be informed!

Pillar 1: Market depth

This pillar examines the size of markets, liquidity, product diversity, primary dealer system as well as the countries’ efforts to merge their exchanges and launch new markets. Concerning the issue of merging markets, the Index indicates that the ongoing West African Capital Markets Integration programme intends to closely align the exchanges of Ghana, Nigeria, Sierra Leone, Cape Verde and the BRVM (the regional stock exchange of the member states of the West African Economic and Monetary Union (WAEMU).The integration aims at allowing brokers from each country to trade directly on any of the others’ exchanges.

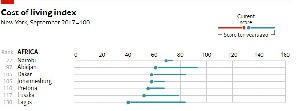

Pillar 2: Access to foreign exchange

This pillar examines the indicators that impact markets’ accessibility to international investors. The various indicators include – the existence and severity of capital controls; exchange rate reporting standards and the level of foreign exchange liquidity. This pillar also addresses the need for the economies to manage volatility resulting from openness. This is measured by central banks’ ability to meet the demand for currency by looking at the ratio of net portfolio flows to reserves. The verdict on Ghana is clear about the country’s effort at boosting foreign exchange liquidity. “Ghana scores low in this pillar overall, though its interbank foreign exchange market has deepened in recent years.” This is because the Bank of Ghana deals heavily in the interbank market and is responsible for almost 60% of total activity, the Index, therefore, excludes the Central Bank’s transactions to reflect market activity only.

The Index, however, acknowledges that the monthly average turnover in the interbank foreign exchange market doubled to around $200m in 2018. The steady increase in monthly interbank foreign exchange turnover was attributed to government’s decision in 2016 to loosen its surrender and repatriation requirements for exporters. This, the Index admits, “allowed the more foreign currency to flow through the commercial banking system rather than being facilitated only by the central bank.”

Pillar 3: Market transparency, tax and regulatory environment

This pillar assesses countries’ regulatory and tax environments for financial markets. The key indicators under this pillar include- reporting and accounting standards; availability of financial information; market development; corporate governance structure; protection of minority shareholders and the existence of credit rating. The Index upholds that these indicators play a fundamental role in offering investors incentives to invest in financial products. These indicators also provide transparency which is vital for fostering investor confidence. Besides, the Index observes that many countries are moving towards supportive tax systems. It, however, states: “in several jurisdictions, transparent financial reporting is hindered by a lack of accounting and audit capacity, attitudes to transparency and enforcement problems.”

But Ghana scores highly, receiving a near-perfect score for its tax regime. This performance was attributed to the country’s tax system as broadly favourable to financial market development due to exemptions on a variety of capital market taxes such as capital gains earned on listed stocks and interest on government bonds to non-residents. The Index also considered the exemptions on interest paid to resident individuals by the government, local financial institutions, unit trust schemes and mutual funds. Also, tax holidays or exemptions for venture capital companies, rural banks and real estate investment trusts also favoured the country’s score.

Pillar 4: Capacity of local investors

This Pillar examines the size of local investors, assessing the level of local demand against the supply of assets available in each market. In this regard, the Index considers how unlocking savings can help lift capital market development. Financial inclusion has been identified as one of the strategies which will complement the build-up of pension assets and allow savings to be invested in a wider variety of products.

See Also: The State of Artisanal Fisheries…How much time does Ghana have?

Pillar 5: Macroeconomic opportunity

This Pillar evaluates economic performance in terms of GDP, macro-data standards (publication and frequency of GDP, inflation and interest rate data); Competitiveness ( growth and absolute export market share); debt profile; living standards; quality of banking sector assets; open monetary policy communication by way of frequency and regular publishing of MPC decisions and meeting schedules , and the timely release of government budgets. With regard to quality of banking sector assets, the Index looks at countries’ banking sector non-performing loans ratios and takes note of the recent reforms in Ghana’s banking sector.

Pillar 6: Legality and enforceability of standard financial markets master agreements

This Pillar measures how well countries have adopted internationally accepted legal standards based on their recognition of master agreements, the enforcement of netting and collateral positions, and the adequacy of insolvency regimes. The Index identifies the following global contractual standards (master agreements) – International Swaps and Derivatives Association (ISDA), Global Master Repurchase Agreement (GMRA) and the Global Master Securities Lending (GMSLA). Ghana is among the eleven (11) countries where ISDA is well recognised for over-the-counter trading. Indeed, ISDA is the most widely used globally. While GMRA has limited use in Ghana, the GMSLA is, however, not in use at all (at least for now) in the country.

About the Insolvency processes under Pillar Six (6), the Index states, “adequate insolvency procedures improve investor confidence, mitigate risks and encourage business growth. “The Index further states that” the refinement of insolvency frameworks, along with the adoption of standard international master agreements, will help business environments thrive. Policy-makers must invest in the legal and contractual frameworks that will enable market players to transact more comfortably on a wider scale.”

Click to view details

Business News of Tuesday, 5 November 2019

Source: thebftonline.com

Financial Markets Index 2019 -The six fundamental pillars you need to know

Entertainment