More and more people continue to paint a picture of grim and doom for the Ghanaian economy as a result of the Akufo-Addo’s government’s refusal to pay valid arrears and invest in infrastructural development for the first half of this year, saying it has impacted negatively on economic growth.

The latest to raise issue with the situation is the Institute for Fiscal Studies (IFS). It has cautioned that government would miss its 2017 budget target, should it fail to spend in critical sectors of the economy.

The IFS warning, comes on the back of an assessment of the economy for the first half of 2017.

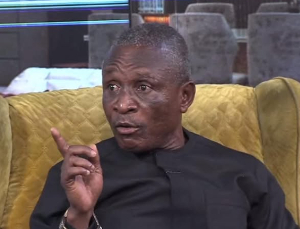

The Executive Director of the IFS, Professor Newman Kusi, explained that the cut in some critical expenditure, has affected economic performance so far.

“The cuts in expenditure have been affected; those that we actually need such as the capital spending, earmarked funds, payment for goods and services among others. But then again the government has its hands tied at its back because it cannot cut back on wages and salaries, interest payments, etc and these together take a disproportionate share of the revenue that is collected,” he stated.

This comes after former Finance minister, Seth Terkper, predicted that the Akufo-Addo government, would miss its budget deficit target for this year, and end up borrowing more to help sustain the economy.

Mr. Terkper, argued that, the government’s efforts to cut tax and also ensure compliance, may make little impact on the Ghanaian economy.

Mr. Terkper’s arguments are contained in an article he released on Tuesday, in which he impressed upon the Akufo-Addo government, not to cut ties with the International Monetary Fund (IMF), even as it concludes the deal next year.

Pius Amihere Eduku of citibusinessnews.com reports that, these assessments come ahead of the midyear budget review by Finance Minister, Ken Ofori Atta to be presented to Parliament on Monday, July 31.

In general, the IFS, described as encouraging, the government’s efforts to achieve economic stability.

Some key indices that the economic think tank lauded included, the declining inflation rate (12.1%), increased oil exploration activities, as well as increased exports among other initiatives undertaken in the first half of 2017.

On fiscal performance and real sector development, the IFS described the 1st half performance as mixed.

The revenue targets fell by 2.3 billion cedis or 17.1percent with government’s expenditure target also dropping by 3.6 billion cedis or 20.5percent.

This was influenced mainly by the tight fiscal and monetary policies pursued by the government.

Meanwhile, Professor Kusi, maintains the government needs to do more to propel economic growth.

“So the government would have to look at how to clean the expenditure in such a way that the little spend will give the country the needed benefits for instance Irregular payments, unbudgeted expenditures among others must be cleaned.”

While optimistic of prospects for economic growth, the IFS warns the issues would also require strict adherence to prudent financial management in order to reduce the government’s debt burden from borrowing.

“By implementing effectively and strictly the provisions of the Public Financial Management Act (PFMA) and the Public Procurement Act (PPA). I am sure that, if these two laws are implemented to the latter, there’s a lot of money that the government can save even if revenue is increasing to deal with that.”

According to the immediate past Finance Minister, there seems to be no evidence in the six months’ old administration of Akufo-Addo that, tax compliance and expenditure cuts alone, can fill the fiscal space.

He contends that this will result in more borrowing in the absence of Highly Indebted Poor Countries (HIPC) space.

Even though, the NDC, ended its administration last year with a budget deficit of 8.7 percent, the NPP government is confident of reducing the figure to 6.5 percent by the end of this year.

This is still lower than the 51/4 percent target set by the IMF.

The former Finance Minister, took a dig at the Akufo-Addo government, when he alluded to what he describes as a convergence of policy thinking.

These include; the seeming agreement on the inevitability of ‘smart borrowing’ and debt management with mechanisms such as the institution of a Sinking Fund, Buy-Back, refinancing, escrow/self-financing, among others.

In addition, Seth Terkper, wants the government to stop cutting back on substantive tax measures such as the Energy Sector Levy Act (ESLA) and the 17.5 per cent VAT in addition to other Public Financial Management measures such as GIFMIS.

Business News of Friday, 28 July 2017

Source: theheraldghana.com