GCB Bank has given support to the Bank of Ghana (BoG) over the establishment of special court to handle financial cases in the country.

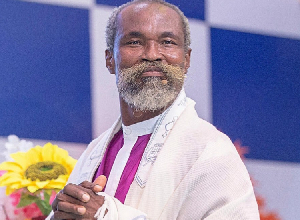

The backing of the BoG by GCB Bank was done by its Managing Director Mr. Ransford Adzetey Sowah, who is of the view that such action will enable to the Central Bank to sanitize the banking sector to some extent.

“I believe that whatever system is used something needs to be done about dealing with infractions in the financial services system. So whichever way is done, I support it. Nothing being done is a problem, something being done is fine,” those were the words of GCB’s Managing Director when he spoke to Citi Business News.

The governor of the BoG, Dr. Ernest Yedu Addison during the fourth edition of the Ghana CEO Summit in Accra, on Monday, May 20, called for a designation of special courts and judges to adjudicate matters arising out of the specific resolutions and revocation of licences as well as cases relating to collateral disclosure.

He said this at the backdrop of the disclosure that about 50 cases are currently being pursued in court over repayment of loans by collapsed banks.

He also stated that, out of a total loan of about GH¢ 10.1 billion taken over by the receivers, only GH¢ 731 million has been recovered through loan repayment by customers, or through placement, sale of vehicles, liquidation of bonds and from other income sources.

All these are as a result of reforms in the banking sector which led to the revocation of the licences and eventual takeover of two banks; UT, Capital Bank by GCB Bank.

The BoG also on August 1, 2018, withdrew the license of five Ghanaian Banks after their inability to meet the new capital requirements for banks in Ghana. The Banks were; Construction Bank, Beige Bank, Royal Bank, UniBank and Sovereign Bank, and transferred all their assets and liabilities to the Consolidated Bank of Ghana

Business News of Sunday, 26 May 2019

Source: ghanacrusader.com