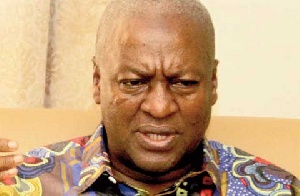

Ghana Revenue Authority (GRA) has signalled its plan to enforce gifts tax in Ghana, beginning from former President Mahama’s 600,000 Ghana cedis funds he raised from donations and gifts from National Democratic Congress sympathizers countrywide, MyNewsGh.com has learnt.

An enquiry by our Business Desk on rumours regarding such a move revealed that the Ghana Revenue Authority (GRA) intends to strictly enforce the 15% gifts tax rate on any gift valued at GH¢50 and above, an official of GRA told MyNewsGh.com.

The amendment of the VAT Act 810 increased the gifts tax from 5% to 15% and made it mandatory for GRA to charge it on gifts received from loved ones.

Peter A. Williams, a certified tax consultant defined a gift “as a thing given willingly to someone without payment. A gift is also defined to mean a receipt without consideration or for inadequate consideration.

According to Ali-Nakyea in his book Taxation in Ghana, There are two distinctions of gifts under the Internal Revenue Act, Act 592 section 8(3) and under section 105 of the same Act.

Gift under section 8(3) arise out of one’s employment relationship, donated by the employer, an associate of the employer or a third party under an arrangement with the employer or an associate of the employer, whereas gifts under section 105 are taxable gifts as provided by the law.

The tax payable on gifts under section 8(3) is at a graduated rate that is added to the employee’s income and taxed appropriate like PAYE, whereas that under section 105 is taxed at 15%.

Under section 8(3), the whole amount of the gift is taxable whereas that of section 105 is not taxable where it does not exceed GHS 50.00. It is only the excess amount that is taxable.

Business News of Tuesday, 11 December 2018

Source: mynewsgh.com