The Bank of Ghana has stated that the recently launched Ghana Gold Coin (GGC) is manufactured from “responsibly mined gold” from Ghana, refined to 99.99% purity.

The coin, which is issued and guaranteed by the Bank of Ghana (BoG), is available in 1 oz, 1/2 oz, and 1/4 oz sizes “to suit different investment needs.”

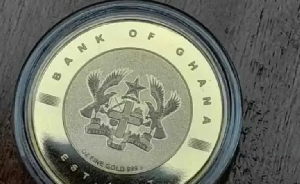

In a Frequently Asked Questions publication on its website, the central bank explained that each coin has the Ghana Coat of Arms on the front and the Independence Arch on the back.

The packaging includes the gold coin, a wooden storage box, a transparent coin holder, and a certificate of ownership.

The regulator noted that the gold used for the manufacture of the Ghana Gold Coin is from “traceable, responsibly mined sources” in Ghana, in line with the bank’s Responsible Gold Sourcing Framework.

Explaining the rationale behind the introduction of the coin, the BoG said: “The GGC gives savers resident in Ghana an additional avenue to invest and reap the benefits” from the central bank’s domestic gold purchase programme, adding: “Gold can serve as a natural hedge during periods of economic turbulence.”

The issuance of the GGC, the BoG further explained, “broadens access to this enduring financial asset, enabling investors to diversify their financial portfolios.”

The 1 oz coin contains one ounce of pure gold and is 34mm in dimension. The 1/2 oz coin contains half an ounce of pure gold and is 27mm in dimension, while the 1/4 oz coin contains a quarter ounce of pure gold and is 22mm in dimension.

The BoG noted that each coin is “manufactured from 99.99% responsibly mined and refined gold, which gives the coin the original gold colour.”

The basis for the pricing of the coin will be the previous day's London Bullion Marketing Association (LBMA) Auction afternoon (PM) Price, the central bank explained, pointing out that the applicable transaction exchange rate for pricing shall be the United States dollar against the Ghana cedi rate quoted using the previous day's close Bloomberg REGN Mid-Rate.

The price of the coin will be published on the bank’s website daily by 9:00 am GMT using the previous day's close of LBMA Auction PM Price and Bloomberg REGN Mid-Rate USDGHS exchange rate.

The currency for transactions shall be in Ghana cedis for resident buyers based on the prevailing cedi-dollar exchange rate, said the bank.

It informed the public that commercial banks will be the main channel for the buying and selling of the coin to the public, noting: “Commercial banks can buy GGC on behalf of their customers and as part of the process, they shall be required to open a gold account with BoG to facilitate this transaction. The BoG will not sell to or buy gold coins directly from the public.”

The bank advised that buyers may keep the physical gold coin or deposit it with their commercial banks for safekeeping at a marginal fee.

Also, it said commercial banks may charge customers a transaction fee for the resale of the coin. “A uniform fee will be charged to cover associated value-added costs of the gold coin and the wooden storage box incurred by the BoG,” the FAQs stated.

However, customers can “only pay through their bank or mobile money accounts,” since no cash would be accepted for the coin.

Additionally, the BoG clarified that the Ghana Gold Coin, unlike notes and coins in circulation, is not legal tender but a financial asset.

The bank said it is working on distribution platforms for trading the GGC outside of Ghana but for now, such a service is unavailable.

To buy the coins, the BoG said: “You must place a gold coin order at your bank, specifying the desired weight of the coin and the quantity you need. You are expected to have enough Ghana cedis in your bank account to cover the purchase. Your bank will then place a buy order at the BoG the same day to purchase the GGC on your behalf.”

The bank said: “There are no limits on your purchase. You can hold as many gold coins as you can afford.”

On the other hand, to sell the coin to a bank, the BoG advises that customers check the current price of the gold coin on the bank’s website or any other authorised platform and “place a sale order to your bank stating the quantity of coins you want to sell.”

The seller must then get “your coins authenticated for settlement at the bank or any institution authorised by BoG.”

The Bank said it “guarantees GGC, so, if the banks are not able to buy back, the BoG stands ready to buy back,” adding: “Some discounts may apply.”

To ensure that the issuance of gold coins does not promote money laundering, the bank said it has implemented “stringent Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) measures to ensure that the issuance of gold coins complies with national and international regulations.”

It assured the public that, “All transactions shall be routed through banks where customers have been subjected to thorough ‘Know Your Customer and Customer Due Diligence’ checks and sources of funds are proven. In addition, transaction monitoring and reporting of suspicious activities frameworks shall be in place,” and “All buyers will be required to undergo identity verification, and transactions will be subject to limits that trigger additional scrutiny if exceeded.”

These measures, according to the BoG, “are designed to prevent the use of gold coins in illicit activities.”

To prevent the coins from being used to finance terrorism, the bank said: “Purchases are screened against national and international sanctions lists. This also includes the verification of the source of funds for all purchases and monitoring of all high-risk transactions.”

The bank said it will ensure that large GGC transactions are conducted “transparently and in compliance with AML/CFT regulations,” noting: “Mandatory identity verification, transaction reporting, and strict compliance will be required as part of the BoG’s AML/CFT framework on the banking sector to ensure that the GGC is not used to circumvent existing financial regulations.”

To ensure that the proceeds from the sale of GGC are not linked to criminal activities, the regulator said commercial banks and authorised institutions involved in the sale and purchase of the coin are required to implement robust AML/CFT checks, including monitoring for any red flags that could indicate suspicious activity.

Watch the latest edition of BizTech below:

Ghana’s leading digital news platform, GhanaWeb, in conjunction with the Korle-Bu Teaching Hospital, is embarking on an aggressive campaign which is geared towards ensuring that parliament passes comprehensive legislation to guide organ harvesting, organ donation, and organ transplantation in the country.

Click here to follow the GhanaWeb Business WhatsApp channel

Business News of Thursday, 3 October 2024

Source: classfmonline.com