The Ghana Revenue Authority in Accra today, March 7th outlined implementation plan for the Tax Amnesty Act.

The Act was passed in December by parliament as part of plans to improve voluntary tax compliance and open the tax net of the Ghana Revenue Authority (GRA).

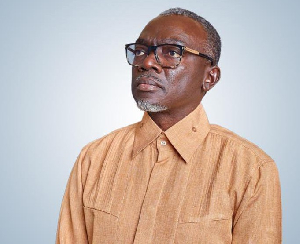

Speaking at the press briefing, Commissioner General of the GRA, Emmanuel Kofi Nti said, the tax amnesty Act is an opportunity for all taxpayers and potential tax payers who have defaulted to discharge their obligation voluntarily.

“Tax defaulters should take advantage of this opportunity and discharge their obligations in exchange for forgiveness of and or some cases the tax, interest, and penalties without fear of prosecution” he added.

Mr. Nti said the Tax Amnesty Act seeks to improve the tax compliance culture, update the GRA database and broaden the tax net of the Ghana Revenue Authority.

However he was quick to add that, anybody who fails to comply with the Act will be hunt down and prosecuted.

“I wish to say that as a compliance measure, this is the last time GRA and government will be offering a tax amnesty for defaulting businesses and persons, so all defaulters should take advantage of this opportunity because GRA has the capacity to identify all potential taxpayers”

According to him, the Amnesty starts from now till the 30th of September 2018, adding that the Authority seeks to redeem a total of GHC300 million to GHC500 million at the end of the exercises.

Background

The Tax Amnesty Act, 2017,(ACT 955) passed by parliament in December 2017 is a limited-time opportunity for taxpayers and potential taxpayers who have defaulted in any of the four basic requirements for tax compliance: Registration with Ghana Revenue Authority, Filing of tax returns by due dates, paying taxes on due date and Making full disclosure of financial reporting.

The Act is aimed at facilitating the regularization of the tax affairs of persons who have defaulted in meeting their tax obligations.

Business News of Wednesday, 7 March 2018

Source: www.ghanaweb.com