Accra Feb. 19, GNA- Governments of Ghana and Italy on Thursday signed a convention on the avoidance of double taxation at a ceremony in Accra. This means that citizens of both countries may choose to honour specific tax obligations in one country and would not be required to do so by the other country.

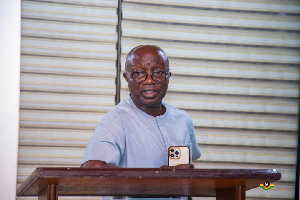

Mr Yaw Osafo-Maafo, Minister of Finance and Economic Planning signed for the government while Mr Giancarlo Izzo, Italian Ambassador to Ghana initialled for his country.

Mr Osafo-Maafo noted that the signing of the convention emphasised government's determination to create an enabling environment for the private sector, adding: "it marked another milestone in the ever-growing bilateral economic relations between Ghana and Italy."

"Nationals of both countries now have the flexibility required to focus on growing their businesses without expending precious time dealing with complex tax issues in two separate jurisdiction," the Minister said. "Taxes to be covered in Ghana are income, capital gains, petroleum, mineral and mining, whilst in the case of Italy, personal income tax, corporate income tax and regional tax on productive activities would be covered," he added.

The Minister commended the Italian government for assisting Ghana with food aid and providing a 10-million-dollar long-term loan as a revolving fund for Small and Medium Enterprises to procure needed capital equipment and raw materials.

He announced that the Internal Revenue Service (IRS) would be provided with the list of companies, which go by the convention, adding that nationals of both countries would have to produce relevant documents and receipts on their businesses.

Ambassador Izzo announced the establishment of a 15-million-dollar Agro-processing company by name Trusty Fruits, in Tema, which had commenced business, adding that there were more to come. He hoped the agreement would facilitate an enabling environment for Italian investors and Ghanaian businessmen resident in Italy.

Business News of Thursday, 19 February 2004

Source: GNA

Ghana and Italy sign convention on double taxation

Opinions