The Ghana Plastic Manufacturers Association has asserted that the illegal sale of plastics by some free zones companies has cost the country about GH¢264 million annually.

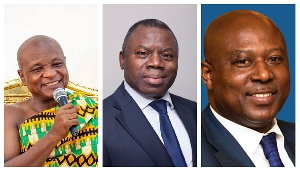

According to President of the Association, Ebbo Botwe, in an interview said the revenue dip was a result of these free zones companies importing plastic raw materials under duty-free conditions and illegally selling them on the market.

"One sad part of this tax is that in Ghana currently, we have about 166 plastic manufacturing companies, and out of this, just about 12 of them are Free Zones Enterprise registered. Some of these 12 registered Free Zone Companies are importing plastic raw materials and illegally selling them on the open local market, thereby causing the government to lose millions and millions in revenue by way of avoiding payment of import duties – thus depriving the government of the needed revenue. Free Zone Companies are exempted from paying import duties," he is quoted by citinewsroom.com

"It is estimated that the government is losing approximately GH¢22.05 million per month or GH¢264.6 million annually through these illegal activities. This is a serious revenue leakage, and we believe we have given enough information to the government to help stop this practice, but instead, here we are saddled with yet another new tax," the President of the Ghana Plastic Manufacturers Association asserted.

Meanwhile, the Ghana Free Zones Authority in a press release said it has commenced monitoring the activities of these companies within their enclave for the third quarter of the year.

GFZA offers a 100% exemption from payment of direct and indirect duties and levies on all imports for production and exports from free zones.

It gives a 100% exemption from payment of income tax on profits for 10 years, which will not exceed 15 percent thereafter.

There is also total exemption from payment of withholding taxes from dividends arising out of Free Zones investments.

SA/MA

Business News of Wednesday, 29 May 2024

Source: www.ghanaweb.com