In anticipation of the introduction of more capital market products to Ghana’s markets, the Central Securities Depository (CSD) Limited is moving to install a new CSD platform with expanded functionalities by October.

An agreement to that effect had been signed with Millennium Information Technologies of Sri Lanka, a member of the London Stock Exchange Group, to undertake the installation.

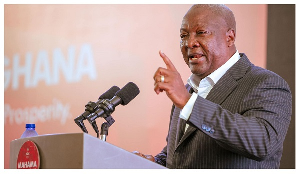

Mr Stephen Tetteh, Chief Executive Officer (CEO) of the CSD said the new platform would be interfaced with the Automated Trading System of the Ghana Stock Exchange and the Real Time Gross Settlement System of the Bank of Ghana for straight-through processing of transactions.

“It would also be linked to all the dealers including all banks, brokers, custodians and registrars. When the platform is completed, investors will hold their shares and treasury bills and bonds in a single account,” Mr Tetteh told journalists at a briefing.

He said the new platform could handle Securities Lending and Borrowing, Collateral Management, Risk Management and derivatives.

It also has the tools that would allow investors to have on-line access to their accounts.

The CEO noted that CSD had seen significant growth in the first year of operations since the Central Securities Depository and the Ghana Stock Exchange Securities Depository merged in January 2014 to bring onto the capital market efficiency and reduction of cost.

He said there was more than 100 per cent growth in operating income from GH? 5,402,861.00 in 2013 to GH? 11,159,765.00 in 2014 while total assets increased by 41.43 per cent to GH? 12,095,166.00 from GH? 8,492,088.00 in 2013.

At the end of 2014, the Depository has opened 647,212 accounts for investors in government of Ghana securities and 82,481 for shareholders in equity.

There was also the conversion of 8.5 billion shares in paper certificates into electronic shares, representing 85 per cent of all shares listed on the Ghana Stock Exchange.

Mr Tetteh said the value of Government’s Securities outstanding in the Depository totalled GH? 28.16 billion at the end of 2014 of which foreign investors hold about 25 per cent.

To drive the Ghana Securities Depository’s vision of becoming a world class institution, he said a five-year medium term strategic plan had been developed for 2015 to 2019.

Mr Tetteh said within the period, the CSD hope to establish strategic alliances with International securities depositories that would help it enter the European and African Capital Markets.

There are also discussions with the London Stock Exchange to sign a memorandum of understanding.

Mr Tetteh said the CSD Ghana Limited would organise a series of public forums to educate investors and to increase awareness of the general public on their services.

Business News of Thursday, 7 May 2015

Source: GNA