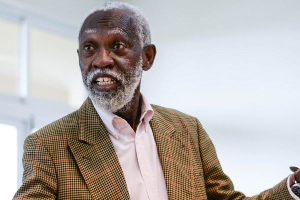

Henry Bukari, Managing Director of Phoenix Insurance, has officially handed over the mantle of leadership as Chairman of the Council of Bureaux of the ECOWAS Brown Card Insurance Scheme.

His one-year tenure was marked by significant achievements, notably the successful revision of the Scheme’s technical texts, simplifying its administration for the benefit of stakeholders.

The handover ceremony was a key segment of the 40th Annual General Meeting (AGM) of the ECOWAS Brown Card Insurance Scheme, held in Lomé, Togo.

Bukari's successor, Simon Pierre Gouem, Managing Director of Sanlam Insurance, Togo, was sworn in by Her Ladyship Justice Mouzou Mehebe, a Judge of the Circuit Court of Togo.

The ECOWAS Brown Card Insurance Scheme was established 42 years ago by the ECOWAS Heads of State to facilitate seamless movement of people and goods across the sub-region.

It aims to provide swift and fair compensation to victims of motor vehicle accidents caused by non-resident motorists in ECOWAS member states.

The system extends motor insurance coverage across borders, promoting regional integration and ensuring the protection of ECOWAS citizens.

Over its history, the Scheme has played a vital role in supporting cross-border commerce and travel while addressing challenges in claims settlement.

The AGM brought together heads of various insurance companies from across the sub-region to reflect on the achievements, challenges, and prospects of the ECOWAS Brown Card system.

Some of the discussions emphasised the progress made in modernising the scheme, ongoing reforms, including the digitisation of insurance services for improved efficiency, and strategies to enhance regional integration through better claims management.

The President of the ECOWAS Commission, H.E. Omar Alieu Touray, commended the strong participation in the AGM.

He encouraged stakeholders to continue implementing reforms that strengthen free movement within the region, particularly through digital transformation.

In his opening remarks, the outgoing Chairman Henry Bukari highlighted the strides made during his tenure, including the revised technical texts governing claims settlement, updated to reflect modern practices and align with sub-regional systems like the CIMA Code, improved claims settlement, and zonal collaboration.

He also stressed the importance of timely compensation for accident victims, noting that "delays undermine the objectives of the Scheme"

He also touched on the inaugural zonal meeting in Conakry, Guinea (May 2024), successfully outlining objectives to strengthen claims settlement and streamline administrative processes.

Bukari urged stakeholders to empathise with accident victims and prioritize swift compensation, noting that “everyone is a potential accident victim anywhere.”

He expressed confidence that these reforms would enhance public confidence in the system and improve outcomes for all stakeholders.

The AGM also addressed the future of cross-border insurance in the digital age, a theme resonating with Togo’s commitment to digital transformation.

Presentations explored opportunities for synergy among member countries, such as:

* Automatic issuance of Brown Cards.

* Integration of motor insurance databases for seamless claims processing.

Key participants included; Winfred Kwesi Dodzi, Secretary-General of the Permanent Secretariat of the Scheme, Benjamin Yamoah, Chairman of the Ghana National Bureau, and Richard Eshun, General Secretary of the Ghana National Bureau.

Other notable attendees included; Albert Siaw-Boateng, Director of Free Movement of the ECOWAS Commission, and Ambassador Ali Bangura, Chairman of Sierra Leone’s National Bureau.

With renewed focus on reforms, digital innovation, and regional collaboration, the ECOWAS Brown Card Insurance Scheme continues to build on its founding vision of facilitating integration and ensuring protection for all ECOWAS citizens.

Watch the latest edition of BizTech below:

Click here to follow the GhanaWeb Business WhatsApp channel

Click to view details

Business News of Friday, 22 November 2024

Source: www.ghanaweb.com

Ghana's Henry Bukari hands over Chairmanship of ECOWAS Brown Card Council of Bureaux

Opinions