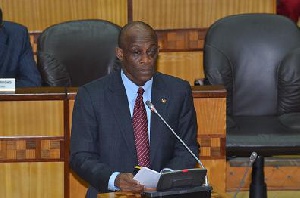

The Minister of Finance, Seth Terkper, and the Governor of the Bank of Ghana, Henry Kofi Wampah, have contradicted each other over the level of Ghana’s total public debt stock, with the two Mahama appointees bandying different figures for the same period under review.

It is recalled that Seth Terkper while presenting the 2014 budget, indicated that “the stock of public debt (including Government guaranteed debt) increased by 22.7 percent from US$19,150.78 million at the end of 2012 to a provisional estimate of US$23,498.76 million at the end of September 2013. As a percentage of GDP, the public debt increased from 49.3 percent at the end of 2012 to 52.0 percent at the end of September 2013.”

Per prevailing forex rates, the total public debt stock of US$23,498.76 million, at the end of September 2013, which was quoted by Seth Terkper, translates into Ghc51.69 billion.

However, yesterday when addressing the Monetary Policy Committee press conference, Dr Wampah, Governor of the Bank of Ghana, stated a completely different figure as Ghana’s total public debt stock, leaving many economic analysts wondering what Ghana’s total debt stock actually is.

According to Dr Wampah, “The total public sector debt stock as at the end of September 2013 was Ghc46.1 billion (53.5% of GDP), up from Ghc35.1 billion at the end of December 2012.”

“Who are we to believe now, the Finance Minister or the Governor of the Bank of Ghana? Is Ghana’s debt Ghc51.69 billion as per the Minister’s presentation or Ghc46.1 billion quoted by the Governor of the Central Bank? As a percentage of GDP, is the public debt 52% or 53.5%? These are questions that have to be clarified as quickly as possible,” an economist told the New Statesman.

Meanwhile, the Monetary Policy Committee of the Bank of Ghana has revealed that consumer and business confidence is falling, largely as a result of the mismanagement of the Ghanaian economy by the John Mahama led National Democratic Congress administration.

At the MPC press conference held yesterday at the Bank of Ghana, the Governor of the Central Bank revealed that “consumer and business confidence indices fell during the period” under review, between September and November 2013.

According to Dr Wampah, “The overall consumer confidence index stood at 89.3 in October, down from 97.2 in August. Similarly, the business sentiments indicator dipped to 90.8 in September from 92.4 in June.”

This confirms complaints by the business owners in the country about the rising cost of doing business in the country necessitated by the hikes in utility tariffs amongst others.

The Governor of the Bank also confirmed that provisional data on the execution of the 2013 budget for the first nine months of the year shows that both revenue and expenditure fell short of their respective targets, adding that the shortfall in revenue was much higher than the reduction in expenditure.

“Total revenue and grants amounted to Ghc13.9 billion (15.9% of GDP) falling short of the target of Ghc16.3 billion (18.4% of GDP). The shortfall in government receipts was mainly the result of lower than budgeted domestic revenue collections on account of lower import volumes, decline in commodity prices on the world market and slowdown in economic activity during the first half of the year, due partly to the energy crisis,” he said.

He continued, “Total expenditure, including payments made for the clearance of arrears and outstanding commitments, was Ghc21.2 billion (24.3% of GDP) compared with the budgeted ceiling of Ghc22.7 billion (26.1% of GDP). Compensation of employees of Ghc6.6 billion and interest payments of Ghc3.3 billion, represented 74.1 percent of domestic revenue.”

Touching on the overall budget deficit which stood at 12.1% at the end of 2012, he explained that the deficit for the first nine months of 2013 was GH¢7.3 billion equivalent to 8.4 per cent of GDP, against a target of 7.2 per cent.

The deficit, according to him, was financed mainly from the domestic sector, resulting in a Net Domestic Financing of the budget of Ghc5.1 billion (5.9% of GDP), compared with the budget target of Ghc4.7 billion (5.4% of GDP).

Business News of Friday, 29 November 2013

Source: The New Statesman

Ghana’s Total Debt: BoG Governor contradicts Seth Terkper

Entertainment