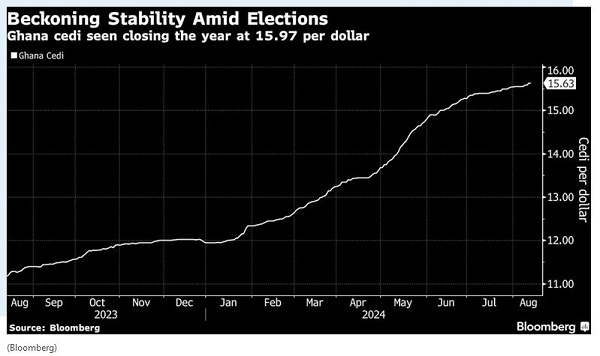

The worst may be over for Ghana’s battered cedi, with analysts expecting it to only weaken modestly between now and December elections following steep falls earlier in the year.

The currency of the world’s second-largest cocoa producer may end the year at 15.97 per dollar, said Oyinkansola Samuel, an analyst at FirstRand Ltd.’s RMB Nigeria unit. That’s just 2% weaker than current levels around 15.63 per dollar, after it shed around 23% of its value against the greenback — a slide that made it the fifth-worst performing currency tracked by Bloomberg this year.

The cedi has been hurt by this year’s poor cocoa crop, which provides Ghana with a vital source of foreign-exchange earnings, as well as investor concerns during prolonged debt-restructuring talks that only reached key milestones in July.

“The currency is still expected to come under some pressure with corporate demand continuing to outstrip supply,” Samuel said. “We expect the depreciation pace to slow going into the end of the year as multilateral disbursements and ample reserve accumulation improve market sentiments,” she said.

Ghana’s gross international reserves increased to $6.9 billion at end-June from $5.3 billion a year earlier. In a further source of support, the Bank of Ghana left its benchmark interest rate unchanged at 29% on July 27 for a third straight meeting, citing exchange-rate pressures.

Local appetite for greenbacks is also expected to be fanned by elections in December. Ghanaian politics is traditionally a costly affair, spawning election-year spending as well as imports directly associated with the campaign.

Helping the cedi this time around will be anticipated dollar inflows thanks to disbursements from the International Monetary Fund, which is expected to unlock funds from other multi-lateral lenders. The IMF granted Ghana emergency support after the West African nation defaulted on its debt in 2022.

It has received $1.6 billion so far under the $3 billion bailout it agreed with the Washington-based lender in May 2023, and expects an additional $360 million payment in the fourth quarter.

On top of that, the World Bank has earmarked $900 million in so-called resilient recovery development policy financing for Ghana, of which $300 million has already been released.

“While foreign exchange demand-supply mismatches persist, they seem to have eased,” said Samir Gadio, head of Africa strategy at Standard Chartered Bank Plc.

“Cedi depreciation could slow on better market sentiment, Eurobond and official creditor debt restructuring deals, IMF disbursement and an upcoming cocoa pre-export financing facility,” he said.

Ghana aims to raise $1.5 billion in syndicated loans this year for cocoa purchase in the 2024-2025 season, though it may not meet this target due to uncertainty over the harvest.

That’s what happened last time around, when it sought to borrow $800 million but international banks would only lend it $600 million as cocoa output slumped amid inclement weather and disease, and as industry regulator Ghana Cocoa Board restructured domestic debt.

Business News of Wednesday, 14 August 2024

Source: bloomberg.com

Ghana's battered cedi may finally be getting a breather - Analysts

Entertainment