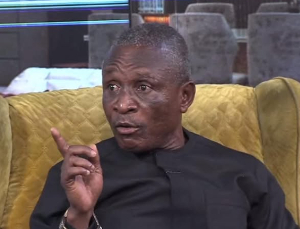

Economist Dr Jerry Monfant has blamed government’s handling of the banking sector for the country’s current economic challenges.

Government has attributed the economic challenges including dwindling revenue, increase in spending, and a high debt to GDP ratio to the Covid-19 pandemic. But Dr Monfant said the claim is questionable.

Speaking on the Morning Starr he said “we tend to believe that policy leakages have led us to where we are. Because the economy is not doing well and we don’t have any other alternatives, the situation is that we are putting more money into the economy and it means your production level is down.”

He noted “our economic situation is self-inflicted and not because of COVID19. Signals have to be sent to the people for them to know the economy wasn’t handled well.”

Explaining his reasoning, he indicated “government had a total policy credibility challenge with regard to economic policies and that has really brought us to where we are at the moment. You do the right thing at the wrong time.”

“For example, in 2016, the financial sector credit facility to the private sector amounted to 34% to the GDP. Exactly in 2018, when we started to be looking at even before we take a bite on the financial sector cleanup, the credit to the private sector went down absolutely to 26% up to the GDP. So, that tells you credit has stifled or is having a nose dive, people’s incomes had equally stifled, it wasn’t flowing.”

He added “our crisis and policy response should be cyclical rather than being procyclical. Borrowing to run an economy can be done by anybody.”

Business News of Wednesday, 11 November 2020

Source: starrfm.com.gh