Ghana's tax system has been described as unfair to the poor as it places huge burden on them in terms of revenue mobilisation compared to the rich.

Dr Steve Manteaw, Co-Chairperson of the Ghana Extractive Industry Transparency Initiative, who stated this, mentioned the value-added tax saying it was not a good instrument for addressing inequality because it made the poor and the rich to pay the same prices for goods, a situation, which further widened the inequality gap in the country.

He was making a presentation at a capacity building workshop on tax and public financial management reporting for media organised by the Tax Justice Coalition, Ghana with support from the Open Society Initiative for West Africa.

The two-day workshop held in Accra, was to build the capacity of the media to help improve the state of public financial management and revenue mobilisation, and how the revenues so mobilised were utilised.

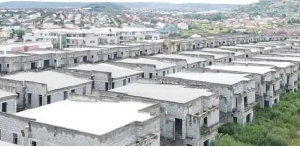

Dr Manteaw argued that the poor were rather contributing more in terms of taxes for national development adding subsidies in the energy sector, meant to cushion the poor, rather tended to benefit the rich compared to the poor.

He expressed the need for a tax system that ensured that people paid taxes based on their abilities to help address inequality in the country.

He also called for efforts to block loopholes that allowed especially big and multinational companies to avoid taxes using transfer pricing amongst other accounting systems to increase revenue mobilisation.

Mr Leonard Shang-Quartey, Coordinator of Tax Justice Coalition, Ghana assured of more collaboration with the media to strengthen their capacity on issues of tax justice to improve media coverage of the sector.

Some of the participants said while tax avoidance was not a crime, the processes leading to it such us over-invoicing and under-invoicing amongst others were crimes and must be singled out for prosecution to help curb the practice for the country to increase revenue mobilisation.

Business News of Sunday, 29 December 2019

Source: www.ghananewsagency.org