The government on Monday issued US$3.025 billion worth of Eurobonds to international investors in four different tranches—a four-year zero-coupon bond and 7-, 12-, and 20-year bonds.

The zero-coupon bond, which is the first of its kind to be issued by an emerging market country, had a face value of US$525 million and will not attract regular interest payments during its tenor. Instead, the bond was issued at a 22 percent discount, meaning the government received 78 cents for every US$100 of the debt sold.

The 7-, 12-, and 20-year bonds had coupon rates of 7.75 percent, 8.625 percent and 8.875 percent, respectively.

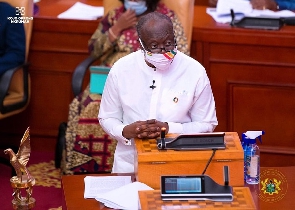

“This historic bond issuance is a strong signal that investors have confidence in our plan for debt sustainability, economic recovery and growth, and that Ghana remains a pillar of stability,” said Finance Minister Ken Ofori-Atta in a statement.

“Part of the proceeds shall be used for domestic liability management. For example, using US$400 million of the zero-coupon bond to refinance domestic debt with an average interest rate of 19 percent will net Ghana savings of some US$200m million over the four years,” he explained.

An economist and fellow at the IMANI policy think tank, Dr. Theo Acheampong, said the yields on the bonds were not surprising.

“I think it is the best they could have gotten,” he said in an interview. “Government is caught between a rock and a hard place. In effect, it looks like investors are interested in the yields and less about Ghana’s challenging public finances,” he added.

The total public debt stock as at December last year stood at GH¢291.6 billion, which was more than 76 percent of the country’s GDP.

Dr. Acheampong said despite the relief offered by the Eurobonds in terms of allowing government access to some liquidity, “it is not so great for the public finances as there’s still a net addition to the debt stock even after using proceeds to repay some of the old maturing debts.”

Business News of Wednesday, 31 March 2021

Source: business24.com.gh