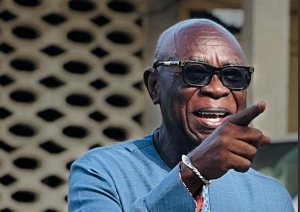

President Nana Addo Dankwa Akufo-Addo has reiterated the importance of banks in Ghana to develop strategic transformational policies to help sustain the country’s economy.

The head of state mentioned that although banks in Ghana have been “content” for the last 20 to 30 years and spawned a lot of money into the system, the investment sector have been “very passive” and not particularly involved in risk taking that contributes to economic development and significant transformation.

President Akufo-Addo was speaking at a forum organized by the Africa Centre for Economic Transformation (ACET) on the need for businesses in Africa to strive to meet with the rest of the world.

He was joined by President Paul Kagame as well as two African CEOs – Chairman and CEO of Dangote Group, Aliko Dangote and Executive Vice President of Unilever (Ghana-Nigeria), Yaw Nsarkoh, to share their visions for transforming the continent and how to finance that transformation, including the key role of foreign and domestic business.

According to Akufo-Addo, who is determined to move Ghana beyond aid, despite foreign loan banks being the major players in the nation’s economy, their pivotal goal is to make more profits and not necessarily concerned about the development of the country.

He was quick to add that, “I don’t have any difficulty with people wanting to make money but I do have a problem with making money in an environment whereby it is not making any significant contribution to the transformation of the economy.”

Identifying the structure of the financial and banking sector as a possible cause of the fiscal hitches, he emphasized that the economic area requires really important policy-making.

“…Policy-making which would promote balance in our country to grow, to become stronger and to take on the role of providing the financial for the transformation that we are looking for.”

“We have not had it so far and it’s an area which government is paying particular attention to because without a solution, without having banks that are prepared to finance relatively risky ventures both in industrial and agricultural initiatives, it is going to be difficult for us to be able to make the transition.” He posited.

Business News of Thursday, 21 June 2018

Source: www.ghanaweb.com

Ghanaian banks need real reform policies - Akufo-Addo

Entertainment