The Association of Ghana Industries (AGI) has indicated that its members need more time to fully comply with the implementation of the requirements of the tax stamp policy, up to the end of the year.

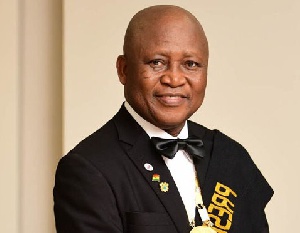

Speaking at a press briefing in Accra on Wednesday on recent development, the President of AGI, Dr. Yaw Adu Gyamfi said the implementation of the Tax Stamp must not stifle the operations of any business that demonstrates compliance, noting that exercise has affected 15 companies, six of which are operating on a large scale.

By this recent action conducted by Ghana Revenue Authority (GRA), the Association counted that the companies have already suffered revenue losses and a dent on reputation of their brands.

The Association notes that following the final decision to implement the paper stamp, the companies have taken all necessary steps that will lead to full compliance including ordering of tax stamp applicator equipment and Purchase Orders, some of which have been shared with Government to demonstrate their commitment.

Some companies are already conducting test runs of their new applicator on production lines.

Dr. Gyamfi said, “without recourse to the tax Stamp implementation arrangements and progress updates that the beverage manufacturers had given the GRA and Ministry of Finance, the GRA task force on Tuesday October 2, 2018 stormed the premises of some of AGI beverage manufacturers unannounced, restricting the movement of products from factory to sales outlets.”

“…all these companies have GRA task officers stationed at the offices, their trucks cannot move. And the sad part is that if we don’t take care about 1,500 people would be going home sitting idle, and that is a great concern,” he added.

Dr. Gyamfi noted that AGI will continue to engage GRA, the Ministry of Finance and all authorities involved, adding that, “these companies cannot stop operations, once they have shown good faith, of buying the tax stamp applicator equipment, while some are already doing the test run.”

“It is a matter of time, and definitely this government is not going to lose the amount of money they are going to make in the years to come, why can’t we deal with a month or two?” he quizzed.

A meeting is scheduled to be held between the AGI and Authorities concerned with the implementation of the tax stamp policy by Friday.

Tax Stamp Policy

Tax Stamps are small stickers with security features supplied by government to some manufacturers and importers to be affixed to their products before they are released onto the market.

The presence of the Tax Stamps on a product, therefore, provides enough guarantee of product authenticity. The Tax Stamp Policy emanates from the Excise Stamp Act, 2013 (Act 873).

Business News of Sunday, 7 October 2018

Source: goldstreetbusiness.com