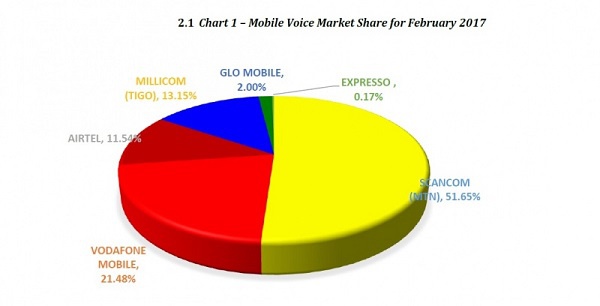

Telecommunication companies Tigo and Airtel were the losers in February 2017 as the total number of voice subscribers for the company dropped marginally.

Tigo’s voice subscriptions decreased from 5,257,424 as at the end of January 2017 to 5,160,279 as at the end of February 2017. This translated into a decrease of 1.85 per cent to have a market share of 13.15 per cent for the month under review.

For Airtel, their voice subscriptions also decreased from 4,565,618 as at the end of January 2017 to 4,529,315 as at the end of February 2017. This represented a decrease of 0.80 per cent. Their total market share for the month under review was 11.54%.

This was contained in the industry information report on telecom subscriptions for February 2017, released by the National Communications Authority (NCA).

At the end of February 2017, the total number of mobile voice subscriptions was 39,234,216. This represents a percentage increase of 1.05% from January 2017’s figure of 38,824,866. The total penetration rate for the month under review was 139.09%.

On the other hand the voice subscriptions for Glo increased by 16.99 per cent for the month. They recorded an increase from 670,399 as at the end of January 2017 to 784,283 at the end of February 2017. Their total market share for the month under review was 2.00%.

Biggest market shareholder MTN’s mobile voice subscriptions for the period was 20,265,399 representing an increase of 2.14% from January 2017’s figure of 19,841,360. MTN’s market share for the month under review was 51.65%.

Vodafone’s mobile voice subscriptions increased from 8,401,072 as at the end of January 2017 to 8,428,088 as at the end of February 2017. This represents an increase of 0.32%. Vodafone’s market share for February 2017 was 21.48%.

Expresso’s voice subscriber figures decreased from 88,993 as at the end of January 2017 to 66,852 as at the end of February 2017. This represents a decrease of 24.88%. Their total market share for the month under review was 0.17%.

Click to view details

Business News of Friday, 28 April 2017

Source: classfmonline.com