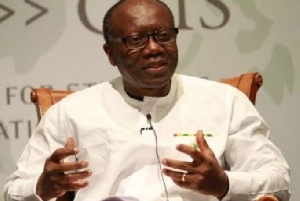

Finance Minister, Ken Ofori-Atta, has indicated that government is putting in place key macroeconomic measures to finally bring an end to the International Monetary Fund (IMF) $ 918 million programme by the close of 2018.

Mr. Ofori-Atta made this known yesterday while presenting the 2018 Mid-Year Budget Review to Parliament.

The presentation of the Mid-Year Budget Review was in accordance with the PFM Law (Act 921, 2016).

It focused on overview of recent macroeconomic developments, representation of revised 2018 fiscal outlook, analysis of the revenue expenditure and financing performance, key highlights of 2018 budget implementation and key policy initiatives.

It would be recalled that under the erstwhile Mahama-led National Democratic Congress (NDC) administration the IMF’s Executive Board approved a $918 million loan to Ghana to support a reform programme aimed at boosting economic growth and job creation while protecting social spending.

The financing programme was due to run for three years, beginning from 2014 to 2017, but was later extended by the current New Patriotic Party (NPP) administration in 2017.

Reviews

In April, this year, the Executive Board of the IMF completed the fifth and sixth review of Ghana’s economic performance under the Extended Credit Facility (ECF) arrangement.

The completion of the review on Monday, April 30, 2018 paved the way for the disbursement of about $191 million, bringing total disbursements under the programme to about $764.1 million.

But the Finance Minister is optimistic the programme would finally come to an end this year, saying government is on course to completing the programme.

He said government was also putting in place measures to sustain the macroeconomic gains in post-IMF era.

Measures

He disclosed that “Mr. Speaker, so the measures for this year to ensure that we meet our fiscal deficit target of 4.5 percent to ensure that we exit the IMF programme, include the conversion of National Health Insurance Scheme 2.5 percent to a straight levy of 2.5 percent.”

He added that “Mr. Speaker, we are converting the GETFUND Value-Added Tax rate of 2.5 percent to a straight levy of 2.5 percent. Mr. Speaker, Mr. Speaker, VAT will thus to be maintained at 12 and half percent.”

Tax On Luxury Cars

The Minister disclosed that government shall “impose a luxury vehicle tax with capacity of 3 litres and above.”

He continued “Mr. Speaker, we are reviewing personal income tax to include an additional ban of GHC10,000 and above per month at the rate of 25 percent.”

Intensification of Tax Compliance

As part of efforts to improve revenue performance, the Minister underscored that government would intensify tax compliance and plug all existing revenue leakages, stressing that “we are intensifying the compliance measures to make sure we collect the taxes that are due us.”

According to him, investigations conducted by government so far show inbound leakages on goods arriving in the country, significant outstanding tax debts, tax audit issues, among others.

He said government was going to roll out major initiatives to address these tax compliance issues, adding that these initiatives would include prosecution of people who evade taxes and corrupt tax officials.

Revenue Protection

The Minister further explained that there would be a new revenue protection and assurance unit, mobile money monitoring and fraud management under the Common Communications Platform.

The Common Platform, he disclosed, would provide government with accurate and comprehensive view of telecom revenues in order to verify tax compliance and ensure the comprehensive billing and collection of all telecoms related taxes, levies and regulatory fees are in force.”

Business News of Friday, 20 July 2018

Source: dailyguideafrica.com