Following months of decline in the yields on short- and medium-term government treasuries, there has been a gradual reversal since July, given prevailing domestic borrowing and refinancing pressures.

Between the end of July, when yields were at their lowest point for the year, to November 9, the 91-day, 182-day and 364-day bill yields increased by 11 basis points (bps), 8 bps and 15 bps, respectively.

At the end of July, the 91-day, 182-day and 364-day bill yields were at 13.97 percent, 14.05 percent and 16.82 percent, respectively, but have increased since then to 14.06, 14.13 and 16.97 percent this week.

Yields on medium-term treasuries during the period increased by 25bps and 15bps for the 2-year note and 3-year bond, respectively. The yield on the 2-year note rose from 18.5 percent to 18.75 percent, while the yield on the 3-year bond increased from 18.85 percent to 19 percent.

But despite the increases since July, on a year-to-date basis, the short- and medium-term treasury yields have contracted. The 91-day, 182-day and 364-day bill yields have contracted by 63 bps, 102 bps and 93 bps, respectively, while the yield on the 2-year note has fallen by 220 bps.

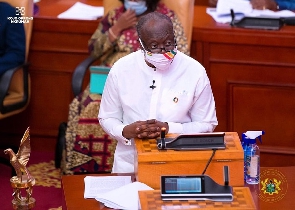

The Finance Minister, Ken Ofori-Atta, in the 2020 mid-year budget statement, indicated that domestic financing of the fiscal deficit will amount to GH¢25.6bn, which represents 6.6 percent of gross domestic product (GDP).

Responding to the development, Mr. Courage Kingsley Martey, Senior Economist with Databank, said the market currently is anticipating further upward pressure on yields in the coming weeks, although this may be tamed by government’s target to keep yields low.

“While we expect the upward pressure to persist on yields across the maturity spectrum for treasury debt, we also believe the treasury is very mindful of its cost of borrowing. As a result, we expect yields to remain around current levels until end-2020, albeit with potential for a slight uptick due to the prevailing domestic refinancing pressure.”

Foreign portfolio investors

Following earlier concerns about the COVID-19 pandemic and its impact on Ghana’s external account balances, there was a substantial sell-off by foreign portfolio investors, which reduced the total foreign holdings of domestic debt to GH¢24.8bn in June from GH¢29.1bn in February, according to the Central Securities Depository (CSD).

Since then, there have been a slight recovery and stability in foreign investor holdings, which stood at GH¢25.5bn in August.

“We believe that most of the election-related outflows had already happened together with the earlier outflows during the second quarter of 2020,” Mr. Martey said.

He added that for the remaining weeks of 2020, the market expects the generally stable position to persist.

“Foreign inflows are being hindered by risk aversion, underpinned by Ghana’s upcoming elections and continued rise in global COVID cases. However, we also do not anticipate any sizable outflows as the [cedi’s] stability against all odds seems to have eased investor concerns,” he said.

Business News of Wednesday, 11 November 2020

Source: thebusiness24online.net

Government domestic borrowing costs inch upwards

Entertainment