Government had outlined several interventions to ensure adequate revenue collection by the Ghana Revenue Authority (GRA) and to address leakages caused by non-compliance and debt on the part of taxpayers.

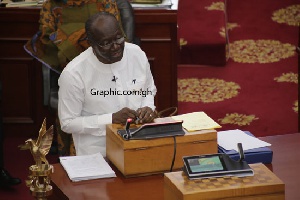

A major part of this move, according Mr. Ken Ofori-Atta, Minister for Finance, is the retooling of the GRA to enable it deliver its mandate of mobilising revenue to finance improvements in the lives of Ghanaians.

“To achieve this, important changes will be made to both the management and personnel of the Ghana Revenue Authority. These interventions will seek to improve the quality of the leadership of GRA and boost the performance, responsiveness and work ethics of the entire GRA workforce. The rigorous performance management tools we have started deploying will be driven to the end,” he said.

Mr. Ofori-Atta, presenting the 2019 budget statement, themed “A stronger Economy for Jobs and Prosperity’, said government will be resolute in prosecuting revenue officers, whose dishonest behaviour led to irregularities and leakages, for criminal collusion with unscrupulous tax payers. Similar strategies will also be deployed towards the National Lotteries Authority, which he said had underperformed its potential for a long time, despite reforms started more than a decade ago.

“There is the need for re-awakening. As a start, we have initiated steps for a full and comprehensive technical audit of the NLA. “Once this has been completed, government will pursue changes (similar to what has been mentioned in respect of GRA) for both management and personnel of the National Lotteries Authority,” he stated.

Government, he noted, will in 2019, treat tax evasion, including deliberate undervaluation of import values, the ex- warehousing of imports from the bonded warehouses without prior payment of customs taxes, the suppression of sales, the non-issuance of VAT receipts for registered VAT businesses, the diversions of goods cleared as transit goods into the domestic market, and other irregularities as crimes that must be prosecuted.

Legal action will also be taken against big tax defaulters in order to recover tax debts and will use various distress actions to retrieve tax liabilities from tax payers who have a habit of defaulting on their tax obligations.

“Mr. Speaker, in this, there will be no sacred cows,” he vowed, adding that tthey will also implement various automated systems in order to reduce human involvement in tax administration, including Electronic Devices to deepen VAT penetration, the Excise Tax Stamp Policy, the harmonization of the automated systems at our ports of entry, and other key systems, the implementation of which will be intensified in 2019.

Business News of Thursday, 15 November 2018

Source: ghananewsagency.org