The Ghana Trades Union Congress (GTUC) has advised government to check the abuse in the tax incentive system, which has denied the country the requisite resources to carry out infrastructural development over the years.

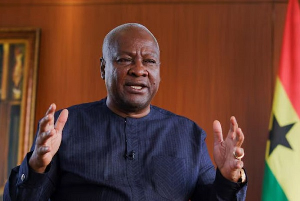

Making a presentation at the World Public Services Day on the topic, ‘The Impact of Illicit Financial Flows (IFFs) Regimes and Public: Public, Social Status,’ recently in Accra, Eric Amoadu-Boateng, Deputy Head of the Organisation Department of the GTUC, said current information revealed that Africa and Ghana were losing from Illicit Financial Flows (IFFs) and harmful tax incentives as well as practices.

The Ghana Integrity Initiative (GII), in partnership with the Tax Justice Coalition and the Public Service International, organised the event.

He cited an Action-Aid report on investment in Ghana, which found that the country was losing over $ 1.2 billion annually due to tax incentives.

He added that 41 percent of trade tax and 28 percent of direct tax and VAT revenues were lost through exemptions in 2012.”

Pointing out that tax justice and IFFs were now topical issues in Africa, Mr Amoadu-Boateng said a high-level panel on IFFs indicated that the continent losses about $60 billion annually.

“However, we find ourselves not investing enough in infrastructure that could deliver quality public goods and services, which are critical in addressing inequality and poverty.

“Ghana, as a country, was also loosing huge revenues from taxes through tax exemptions, fraud/corruption and price transfers, tax evasion, tax avoidance and other illicit transfers by companies.”

He revealed that corporate tax abuses could also be found in other sectors such as the power, petroleum and mining through stability clauses and model agreements.

On the impact of IFFs on fiscal regime and public, Mr Amoadu-Boateng mentioned revenue shortfalls resulting in deficits; declaring that a weak fiscal regime impeded government’s ability to execute fiscal policy.

He said over the last decade, Gross Domestic Product (GDP) has averaged about six percent but it has not led to any significant creation of employment.

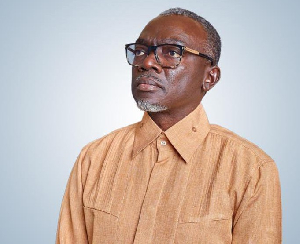

Linda Ofori-Kwafo, Executive Director of the GII, said the commemoration of the World Public Services Day was to deepen the understanding of workers and the public about tax justice and its direct connection with efficient delivery of public services.

She said there was a global push for multinationals to pay their fair share of tax to fund quality public services and sustainable economic development.

Frederick Opare-Ansah, Member of Parliament (MP) for Suhum, who is also a Member of the African Parliamentarians Network on Illicit Financial Flows and Tax (APNIFFT), said the Network planned to spearhead the fight against illicit financial flows in Africa.

Business News of Tuesday, 27 June 2017

Source: dailyguideafrica.com