The government has introduced several tax waivers to be implemented in the 2024 fiscal year.

According to the Minister of Finance, Ken Ofori-Atta, the government is committed to lowering taxes and working with the Ghana Revenue Authority to increase the tax net.

“In that regard, it is difficult to implement all the structural reforms and tax reliefs needed to immediately lower and/or eliminate certain tax handles.

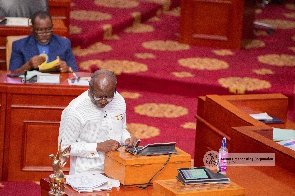

"However, I assure this August House, that we have heard, we believe in lower taxes for industry, and we are working at this aggressively with the GRA and to be cemented with the standing committee of the Mutual Prosperity Dialogue,” he said while presenting the 2024 budget on November 15, 2023.

He said the following reliefs have been prioritized for implementation:

i. Extend zero rate of VAT on locally manufactured African prints for two (2) more years;

ii. Waive import duties on the import of electric vehicles for public transportation for 8 years;

iii. Waive import duties on semi-knocked down and completely knocked down Electric vehicles imported by registered EV assembly companies in Ghana for 8 years;

iv. Extend zero rate of VAT on locally assembled vehicles for 2 more years;

v. Zero rate VAT on locally produced sanitary pads;

vi. Grant import duty waivers for raw materials for the local manufacture of sanitary pads;

vii. Grant exemptions on the importation of agricultural machinery equipment and inputs and medical consumables, raw materials for the pharmaceutical industry;

viii. A VAT flat rate of 5 percent to replace the 15 percent standard VAT rate on all commercial properties will be introduced to simplify administration.

SSD/NOQ

Watch the latest edition of BizTech below:

Ghana’s leading digital news platform, GhanaWeb, in conjunction with the Korle-Bu Teaching Hospital, is embarking on an aggressive campaign which is geared towards ensuring that parliament passes comprehensive legislation to guide organ harvesting, organ donation, and organ transplantation in the country.

Business News of Wednesday, 15 November 2023

Source: www.ghanaweb.com