The current government arguably won last December’s 2016 elections convincingly against the backdrop of a series of commitment to reforms geared towards reviving the Ghanaian economy.

By their nature, reforms for economic recovery usually take the form of reduction in regulations, size of government, and the removal of economic distortions in the market.

A central part of the government’s recovery programme was hinged on the removal of what was termed ‘nuisance taxes’ which truthfully, limited the ability of the private sector to turn around productivity over the last five years, and to credibly contribute to job creation of the economy.

This has been further complemented by the economic reform strategies for the real sector in various forms as outlined in the economic plan presented to Parliament on March 2, 2017.

This brief is the first in a series, which will seek to monitor the performance of the macro-economy - particularly the fiscal out-turns of the economy, amidst the reforms presented in the maiden budget for 2017, and keeping it up with the medium-term targets.

Revenue performance

The expectation of the government as outlined in the 2017 budget statement and economic policy for 2017[1] is a projected growth in revenue of about 33 percent. Without prejudice to the trends occurring in the quarterly revenues accruing to the state, one should expect a quarter on quarter revenue growth, at least with targets being attained.

Again, recognition is given to the possibility of recovery of the real sector in latter quarters of the fiscal year, which could significantly grow revenues beyond expectations - this hardly is the case of successive Ghanaian governments, but we may be wrong.

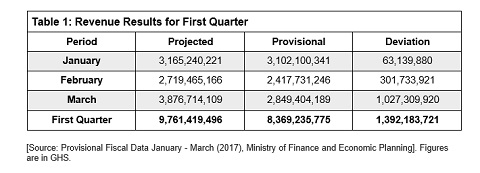

The projected annual revenue stands at GHS 44,961,635,655 (for simplicity reasons we approximate to GHS44.96billion, and approximate other numbers along this format). See table 1 below.

Following from the proposed reforms of government as contained in the budget, the primary concern has been the possible challenges with attaining revenue targets, and the transient effect this could have on the government’s ability to pursue all its programmes in a sustainable manner over the short term.

It will appear that this looks to be materializing as the deviation of actual revenue outturn from projections has widened consistently over the first quarter.

Much as January and February results could be directly attributed to the government’s policy programme (out-doored in March), the policy programme was fairly represented in the State of the Nation’s Address and the manifesto of the government during the 2016 elections with minimal deviations.

To this end, decisions of various economic units have been in anticipation of these reforms with a lot of positive goodwill.

From table 1, revenue targets have been missed for the first quarter by 14 percent, of which domestic revenue fell short of the target by 12 percent.

Company taxes, a component of the domestic tax revenue slipped off the target by 27 percent for the quarter, as other direct taxes missed the target by 7 percent. On indirect taxes, taxes on domestic goods and services fell short by 2 percent, as its components of Communications Service Tax and Value Added Tax (VAT), generated outturns of 6 and 2 percent respectively in excess of the targets for the quarter.

On the external economy, taxes on International Trade (specifically import duties) also missed the projection by 23 percent for the quarter. Non-tax revenue and grants were the biggest ‘culprits’ as target were missed by 21 and 53 percent, respectively.

These results although representing a rather short-term performance appear to be consistent with the challenges that many saw with the strategy of government - decline in revenue, which could jettison the actual implementation of the budget without exuding pressures on the economy and the government’s positive intentions over time. This is worrying and should be monitored appropriately for alternative strategies to be developed.

Expenditure Performance

Expenditure targets for the quarter have also been missed by about 14 percent. The actual outturn for the quarter is GHS10,662,790,250 compared to a projection of GHS12,493,192,656. This ordinarily should be a cause for celebration as expenditure appears to be under control.

However, with the results for three more quarters in the year yet to go, and most government programmes yet to be rolled out, we simply cannot rejoice yet. Opening up the expenditure basket shows an improvement in major lines such as; Compensation 6 percent, Goods and Services 82 percent, Grants to other government units of 37 percent, and Capital expenditure 48 percent.

Some expenditure lines went out of control for the first quarter unlike the above lines mentioned. The most notable one being the expenditure on interest payments which slipped by 15 percent driven by domestic interest payments which missed its GHS 2,592,288,411 target by an extra GHS 576,618,326 for the quarter.

It may be early days yet, but a rethink of some of the strategies will be necessary for the government going forward.

The developments around the financing of the budget is also notable within the first quarter, as the government appears to be pursuing a strategy of shifting its financing burden away from the domestic banks.

Non-bank holding of government financing for the quarter outstretched its target by 115 percent. The Central Bank financed government by GHS 838,474,159, even though no projections were made for this in the first quarter, which is also a worrying, but not out of place phenomenon.

Summary

The performance on revenue particularly domestic tax revenue for the first quarter raises concerns within the short term and is consistent with the fears of many observers of the economy.

Without a significant recovery of real sector productivity, to drive the tax revenue over the next three quarters beyond the government’s projections, efficiency and effectiveness of the 2017 economic plan could be undermined, with debilitating effects on other macro-economic aggregates.

The currency has lost 5.86[2] percent of its value against the United States Dollar for the quarter, despite macro prudential strategies implemented to manage it.

The non-responsiveness of credit costs over the quarter despite indications of a decline in prices with a corresponding monetary policy response, is indicative of structural risks within the economy which will be resolved not only by macro-prudential policies.

There is more to be done, for the economy to get back to work, and create the sustainable jobs, through the budget and economic management plan without further pressures being exerted on the various economic players.

One major and immediate remedy will be for the government to close all the major revenue loopholes, especially those within our ports, which have been assessed to account for only 10 percent of their potential accrual.

Business News of Tuesday, 20 June 2017

Source: IMANI