The economy is bracing itself for another surge in headline inflation come August 2023, with market watchers pointing to the likelihood of additional monetary tightening measures by the Bank of Ghana (BoG) in response.

Elevated food costs continue to fuel the country’s inflationary pressures, marking the third consecutive month of price increases and casting shadows over the economic outlook for the coming month.

The anticipated increase in headline inflation for August has prompted concerns about its impact on the broader economy. As Apakan Securities remarked in its review of the July 2023 inflation data, the unfavourable food harvest season this year – driven by climate change and fertiliser costs – could significantly contribute to a further rise in headline inflation.

This concern is compounded by the recent uptick in ex-pump petroleum prices, fuelled by the surge in Brent crude oil prices on the global market.

“We view the balance of inflation risks on the upside, inducing a further rise in the headline for Aug-2023,” noted Apakan Securities, underscoring challenges the economy is currently navigating.

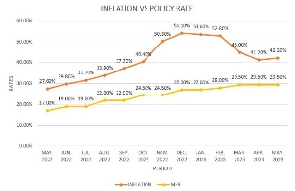

The persistent surge in inflation can be attributed to the rising cost of food items, particularly cereal products and meat. The Ghana Statistical Service (GSS) released data indicating that headline inflation rose to 43.1 percent year-on-year in July 2023 from 42.5 percent year-on-year in June 2023.

The Consumer Price Index (CPI) for the same period grew by 3.60 percent month-on-month in July, after declining slightly to 3.20 percent in June. Food inflation, a significant driver of the overall inflation rate, increased from 54.20 percent year-on-year in June 2023 to 55 percent year-on-year in July 2023, continuing its upward trajectory.

While the price growth of certain food items like cereal products and meat remains high, there are some areas where inflation has shown moderation. For instance, the cost of transport dipped from 37.20 percent year-on-year in June 2023 to 28.50 percent year-on-year in July 2023. Additionally, housing and utilities expenses saw a decrease from 49.20 percent year-on-year in June 2023 to 47.40 percent year-on-year in July 2023.

As the country grapples with these inflationary dynamics, experts are closely monitoring the potential consequences for monetary policy. Constant Capital, in its review of the inflation data, predicted a resumption of the disinflation trend in the near-term; albeit with lingering concerns over persistent food price pressures. The forthcoming major staple crop harvesting season in August and September could offer some reprieve in taming food price pressures, according to the firm.

GCB Capital however painted a cautious picture of the inflation landscape, emphasising that food inflation remains a significant risk to the overall inflation outlook. The food basket’s contribution to the nation’s inflation average has hovered around 55 percent, remaining above the national average.

Potential mitigation offered by the imminent main crop harvest season is weighed against second-round effects of soaring food prices since May 2023 and the proposed quarterly utility tariff adjustment.

“Inflation could quicken in August 2023 if the anticipated price boost from the 2023 main crop harvest season underwhelms,” cautioned GCB Capital, pointing to potential challenges that could lie ahead.

The implications of these inflation dynamics extend to monetary policy and interest rates. While the current monetary policy rate stands at 30 percent, signalling a tight stance, there are considerations about the impact of further tightening measures on economic growth.

GCB Capital acknowledged the possibility of additional monetary tightening if inflation poses a spiralling threat. However, the effectiveness of such measures might be limited – potentially stifling growth, especially in light of ongoing fiscal consolidation efforts.

Ghana’s frontloaded fiscal consolidation efforts align with the central bank’s call for a coordinated fiscal policy approach to control inflation. The potential for another surge in the August inflation trend could lead to a 50 to 100 basis points hike in the policy rate come September, potentially keeping nominal interest rates at elevated levels throughout the third quarter of 2023.

Against the backdrop of a 50 basis points increase in the monetary policy rate to 30 percent, the recent uptick in inflation and reliance on short-term debt for fiscal deficit financing, Constant Capital anticipates a sustained upward bias in money market yields.

As the nation navigates these complex dynamics, the stage is set for a delicate balance between stabilising inflation and fostering economic growth. Policymakers and industry experts are keenly observing how these variables will interact to shape the trajectory of Ghana’s economy in the months ahead.

Business News of Monday, 14 August 2023

Source: thebftonline.com