Parliament is preparing to pass the Insurance Bill, 2020 into law following its second reading on the floor of the house last Monday.

This follows various amendments which were incorporated into the bill by the Finance Committee of Parliament, the National Insurance Commission (NIC) and other stakeholders.

The bill is targeted at increasing insurance penetration in the country which currently remains low, as the Bank of Ghana’s Financial Stability Review pegs insurance coverage at 1 percent of Gross Domestic Products (GDP).

The Bill, meant to replace the Insurance Act of 2006, Act 742 is expected to ensure that the insurance industry is regulated in accordance with international framework and acceptable supervisory standards.

This seeks to mandate insurance companies to comply with international best practices aimed at protecting premiums of customers.

Indeed, the industry has witnessed enormous achievements from recent developments on the international market, among them being the growing number of customers.

Therefore, the insurance bill has become necessary to provide stringent regulatory framework to sustain the industry.

Importantly, one of the major initiatives being championed by the bill has been the need for insurance companies to ensure good corporate governance practices.

Members of Parliament insisted that the move would serve as a check to guide insurance companies to be responsible in their investment decisions.

Background

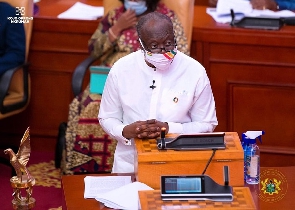

The bill forms part of initiatives of the NIC, under the auspices of the Ministry of Finance to grow the industry by strengthening corporate governance and increasing its accessibility, most especially the informal sector. It was laid in Parliament on 20th October, 2020 by Finance Minister, Ken Ofori-Atta.

Business News of Thursday, 17 December 2020

Source: goldstreetbusiness.com