The Insurance Awareness Coordinators' Group (IACG) has embarked on a series of sensitization programs to increase insurance awareness among micro and small businesses in the country.

This initiative is part of the insurance industry's efforts to make insurance more appealing and accessible to these businesses, with the current insurance coverage in the country standing at around 44.6%.

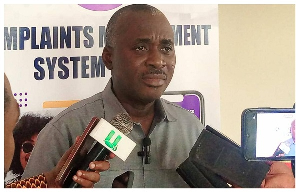

During the inaugural event held in Techiman, in the Bono East Region, at the Micro and Small Business Clinics on Insurance in 2024, the acting Commissioner of Insurance Michael Kofi Andoh, highlighted Ghana's goal to achieve insurance inclusivity for all micro, small, and medium enterprises.

He emphasized the importance of educating these businesses on the signific ance of appropriate insurance policies to protect their businesses and livelihoods.

Mr. Andoh stressed the need to raise awareness and increase demand for micro-insurance products tailored to the low-income segment of the Ghanaian economy.

He emphasized the importance of creating suitable micro-insurance products to assist small businesses in mitigating any potential disasters.

The NIC Commissioner took the opportunity to explain the benefits of the right insurance policies for small business owners and assured that the insurance regulator [NIC] would enhance public education on insurance claims processing to increase confidence in the industry.

He encouraged all MSMEs to secure the necessary insurance coverage for their businesses. Some business owners shared their experiences with insurance policies, citing reasons such as dis trust in insurance providers, lack of alternative coping mechanisms, limited understanding of insurance, and insufficient public education on disaster risks as barriers.

Mr. Andoh pointed out that since about 80% of Ghana's working population is in the informal sector, making insurance more accessible and affordable to them would contribute to the economy's growth.

The clinic, attended by approximately 400 participants, targeted market women, artisans, and other vulnerable groups from the region. Participants hailed from Kintampo, Techiman, Tuobodom, and surrounding areas.

The campaign will continue in Sunyani and Goaso, both in the Bono and Ahafo Regions, respectively. Participants engaged in interactive sessions to understand the nature of insurance and the various types of insurance that could benefit them.

Andoh mentioned that the nationwide campaign, which began in the Ashanti Region last year, was being replicated in Techiman and would extend to Sunyani in the Bono Region and Goaso in the Ahafo Region.

Representatives from all insurance industry bodies and the German Development Corporation (GIZ) attended the Techiman event.

The IACG comprises the National Insurance Commission (NIC), the Ghana Insurers Association (GIA), the Insurance Brokers Association of Ghana (IBAG), and the Chartered Insurance Institute of Ghana (CIIG).

Other stakeholders include the National Association of Ghana Insurance Agents (NAGIA) and the Ghana Insurance College (GIC). The IACG receives support from the German Development Cooperation (GIZ).

Business News of Wednesday, 10 July 2024

Source: Koku Agbenaza, Contributor