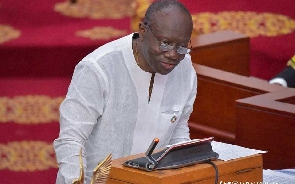

During the announcement of the debt exchange programme by the finance minister on December 5, 2022, he cited the example of Jamaica and Greece, two countries that have undergone debt restructuring in the past.

However, an economist, Dr. Theo Acheampong, has stated that Jamaica was successful because it consulted the persons affected in order to build consensus.

He said: “There has not been as much engagement with the people who will be affected by this domestic exchange program. It is worrying that decisions are made sometimes in silos without carrying on board the people to whom these decisions are affected.

“The reason why in Jamaica it was successful was that they carried the people who will be affected along from day one,” he is quoted by 3news.com.

The finance minister in his address said: “To illustrate the point, let me cite the examples of just two countries among many others in the last 10 years. Jamaica resorted to such operations in the past, notably in 2010 and 2013.

“In both cases, it chose to trust the sense of responsibility of the Jamaican people and proceeded through a voluntary approach. This approach was highly successful, as more than 99% of holders of domestic bonds participated in the exchange. On the contrary, in the case of Greece, the Authorities chose to undertake a coercive approach, whereby a law was passed to force people into participating,” he said.

He added: “We intend to avoid as much as possible the Greek approach, as we strive to reach a consensual solution with our bondholders, which the is Ghanaian way. In any case, the good news is that the Domestic Debt Exchange has yielded positive results both in Greece and Jamaica, and many others, and will certainly put our economy on a much stronger footing. Greece has now recovered full market access. We certainly anticipate a similar success story in Ghana. I want to assure you about the Government’s commitment to do what is necessary to succeed.”

But various unions to be affected by the restructuring have stated their opposition to the program after they noted that the government did not consult stakeholders before taking the decision to undertake the program.

The Director of the Institute of Statistical, Social and Economic Research (ISSER) of the University of Ghana, Professor Peter Quartey has also intimated the need for the government to engage the various bodies to be affected.

“I think in all of these there is the need for consultation or consensus building. It is very critical because you are going to touch people’s funds and certainly, they have to agree to the terms or whatever you want to propose.

“I know that there have been some initial consultations but I don’t think that has been wide enough, that has been deepened enough, and therefore, going forward, I think the government should consult labor, consult pension fund holders, etc so that there is some consensus building in this because we are in this together, without consultations you cannot move forward.

“We cannot also sign onto an IMF programme if we do not agree to a debt restructuring exercise,” he added.

SSD/FNOQ

Business News of Thursday, 8 December 2022

Source: www.ghanaweb.com