Ahead of the June 2023 inflation data release today, market analysts are predicting a rise in the rate due to the renewed price risks from implementing revenue and utility tariff measures.

The shock to the disinflation trend experienced earlier this year is expected to be temporary, as pass-through effects of new levies and utility tariff increases have already impacted general prices.

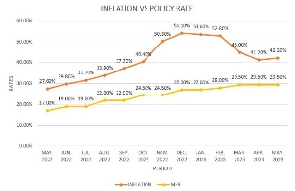

Inflation had shown signs of easing in the first half of 2023, dropping from a peak of 54.1 percent in December 2022 to 41.2 percent in April 2023. However, in May it increased by 100 basis points, reversing the downward trend.

GCB Capital anticipates that the first- and second-round effects of the revenue measures, combined with simmering food prices, will push headline inflation higher in June and possibly July.

GCB Capital believe that the surge in the consumer price index (CPI) is a one-off shock and will normalise in the subsequent month, supporting inflation to return to a downward path. However, the lingering pressures on food costs in June could pose a significant risk to the inflation outlook.

“We expect the second-round effects and lagged impact of the revenue and tariff measures to result in another marginal increase in headline inflation for June and potentially July 2023,” GCB Capital said in its outlook. “However, we expect inflation to resume a decline thereafter, supported by favourable base drift and easing price pressures.”

Conversely, Apakan Securities expects the base effect will support inflation to ease in June-2023, although inflation surprisingly rose in May 2023.

The upcoming release of June inflation data on Wednesday will provide further insights into pricing and guide future policy decisions.

The rise in inflation poses challenges for both fiscal and monetary authorities. The fiscal authorities aim to control rising financing costs to meet IMF programme conditionalities, while the monetary authorities cannot guide interest rates down due to high inflation and recent price developments in the real economy.

In May 2023, consumer inflation unexpectedly rose to 42.2 percent from 41.2 percent in the previous month; halting the promising downward trend. The Ghana Statistical Service (GSS) had observed a gradual slowdown in the rate of price increases earlier this year, with a significant decrease in inflation from 52.8 percent in February to 45 percent in March. However, between March and April the rate of price increase slowed from 7.8 percentage points to 3.8 percentage points.

The increase in inflation was mainly driven by food inflation, which constituted 52.9 percent of the headline inflation print. Food inflation surged to 51.8 percent in May from 48.7 percent in April 2023, with a month-on-month food inflation rate of 6.2 percent. Non-food inflation stood at 34.6 percent compared to 35.4 percent in the previous month.

Business News of Wednesday, 12 July 2023

Source: thebftonline.com