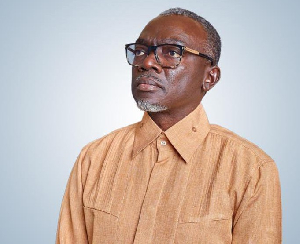

Taxes that were abolished as announced by the Minister of Finance, Ken Ofori Atta in his 2017 budget presentation before parliament are woefully inadequate to positively impact on private business operations, Chief Executive Officer, Ken Kwamena Thompson noted.

Describing the tax cuts as ‘Kakamotobe’, meaning ‘masquerade’ Mr. Thompson asserted the removal of duties imposed on kayayei, religious institutions, real estate, as well as the reduction in the public lighting levy from five per cent to two percent are largely irrelevant to positively impact on the businesses as majority of the people were not complaint in paying.

At a post-budget briefing organized by the Ghana National Chamber of Commerce (GNCC) in Accra, Mr. Thompson said: ‘As a business community, we were looking forward to the government to cut taxes but what we found was that some of the tax incentives introduced have very marginal effects on the development of the private sector.’

Held on the theme: “Leveraging on Government’s Initiatives in the 2017 National Budget for Private Sector Growth,” the event brought together players in the private sector, economic experts and policy makers to discuss opportunities in the budget for the business community.

He also explained that until government buttress measures to curb the depreciation of the local currency against the major foreign currencies, the private sector would always suffer exchange losses.

“Unless we develop measures to curb the depreciation of the cedi against the major foreign currencies, the taxes will not make any direct impact on the private sector. I am not exactly sure why we struggle with cedi depreciation. The cedi will always depreciate; it is the rate at which it depreciates. It is a supply and demand situation,” he said.

Business News of Wednesday, 8 March 2017

Source: www.ghanaweb.com