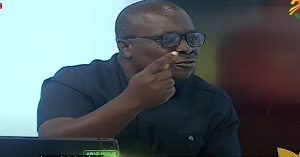

Andrew Appiah-Danquah, a member of Alan Kyerematen’s Movement for Change, has criticised President Nana Akufo-Addo's administration, specifically targeting the Minister of Finance Dr. Mohammed Amin Adam.

Appiah-Danquah expressed that the government’s Domestic Debt Exchange Programme (DDEP), which resulted in the lock-up of funds for numerous individuals across Ghana, has caused a significant loss of investor confidence in the country's economy.

He challenged the Finance minister’s recent claim that the government saved $12 billion through the restructuring as mere "propaganda."

Speaking in an interview with TV3 on October 28, 2024, Appiah-Danquah who is also former member of the ruling New Patriotic Party remarked:

“The issue that Ghana is facing is a fundamental loss of economic credibility over the irresponsible nature of how the Nana Addo government and the Finance Minister has managed the economy.

“The finance minister has now become the chief propagandist. The issue is that because of this debt exchange, people who had confidence in the economy of this country have lost US$12 billion.

"Meanwhile, the safest place to keep your money is in government bonds, which is fundamental. So right now, with young people losing their money, Ghana has suffered a fundamental loss of economic credibility. Nobody will believe in placing money in Ghana. Investors have lost confidence in this country.”

Speaking on a panel discussion held as part of the 2024 Annual Meetings of the International Monetary Fund (IMF) and the World Bank Group on Wednesday, October 23, 2024 the finance minister emphasised that the DDEP had been an instrumental policy measure in addressing Ghana’s financial difficulties and alleviating its debt load, creating a more sustainable fiscal environment.

According to Dr. Amin Adam, the DDEP, launched in December 2022, was a monumental success that laid the groundwork for broader debt restructuring efforts.

“The DDEP was a great success, and we followed that with the restructuring of our bilateral debt, which was also very successful. This led to significant savings of about $2.8 billion. Following this, the restructuring of our Eurobonds, which is about $13 billion, was concluded in the first week of this month, marking another great success.

“The benefits we have derived from this so far include an outright debt cancellation of about $5 billion and another debt service relief of about $4.3 billion. So, between the bilateral creditors and the Eurobonds, we are talking about savings of about $12 billion. We think this is a great success, and we are still working on restructuring our commercial creditors involving about $2.7 billion, which we are working very hard to conclude,” he said.

AM/MA

Watch the latest edition of BizHeadlines below:

Click here to follow the GhanaWeb Business WhatsApp channel

Click to view details

Business News of Tuesday, 29 October 2024

Source: www.ghanaweb.com

Lawyer descends on Finance minister over $12 billion savings claim from debt restructuring

Opinions