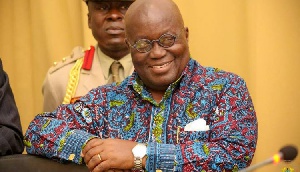

Lending and treasury bills rates have declined significantly since President Nana Addo Dankwa Akufo-Addo took office in January 2017.

This signals an improved monetary economy with increased money supply and credit to consumers.

An increase in the supply of money typically lowers interest rates, which, in turn, generates more investment and puts more money in the hands of consumers, thereby stimulating spending.

Businesses respond by ordering raw materials and increasing production.

An analysis of the figures show there had been a significant improvement in monetary numbers from January 2017 till date.

Today, the 91-day treasury bill is going for 14.70% as against about 16.8% in November 2016.

This means there had been about 2.10 percentage points reduction.

Similarly, the yield on the 182-day bill is 15.1% in January 2020 compared with about 18.5% in December 2016.

There has also been a 3.4 percentage points decline.

For the 1-year Note, the yield is 18.27% today as compared with 21.5% in November 2016.

With regard to the average lending rate, the interest rate was about 33% in November 2016 but has since reduced significantly by 9.3% to 23.7% in November 2019.

Indeed, the yield on the 91-day and 182-day bills had reached a low of 13.3% and 13.8% somewhere in 2018.

Analysts and market watchers say that the above comparative figures mean the President is leading the Ghanaian economy to the right path.

Ahead of the Monetary Policy Committee of the Bank of Ghana’s meeting next week, the average lending rates may decline further, which will be a good omen for consumers as cost of credit will reduce but slightly.

Credit growth rebounded in October 2019 compared to the contraction a year ago, according to the Bank of Ghana’s Monetary Policy report.

Gross loans and advances (excluding the loans under receivership) increased by 17.2%t to GH¢41.65 billion in October 2019 from GHS35.53 billion (-7.6% y/y growth) in October 2018.

Business News of Thursday, 23 January 2020

Source: classfmonline.com