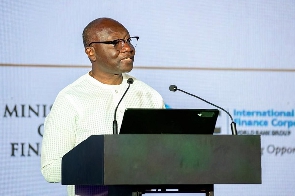

Ken Ofori-Atta, the Minister of Finance, has urged the public to fulfill their tax obligations to enable the government to generate revenue for economic growth.

He said paying taxes was the responsibility of every citizen to help raise funds to implement policies and developmental projects for a good standard of living.

Mr Ofori-Atta made the call when he visited Sol Cement Manufacturing Company in Tema, which was shut down due to tax defaults.

Mr Ofori-Atta said it was very alarming for such a big company to fail to pay tax due the State, adding that the company would not resume operations until the taxes due the state were paid.

He said it was unlawful for companies to use the country's machinery, services and resources to operate for huge sums of money and refuse to pay the tax returns.

The Finance Minister said the Ghana Revenue Authority’s (GRA) efforts in enforcing the tax laws were a good factor to generate income for economic development.

He said the ministry upon seeing this was a signal of new beginning of vigilantism to inform other companies to pay their taxes.

He assured the GRA that the finance ministry would support them in their pursuit of tax collection.

“When the GRA brings up their audit of a company we will follow up and support them”, he said.

He added that citizens should be vigilant to allow customers fulfill their tax responsibilities and advised culprits to desist from such activities.

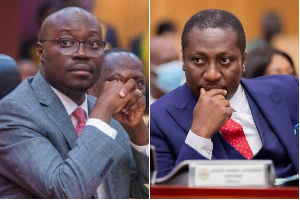

Mr Edward Gyamerah, Commissioner of the Domestic Tax Revenue Division of GRA, said It had been two weeks since the factory was locked yet no action of payment.

However, he said the company proposed a paying period but the Authority was not satisfied with the proposal.

Mr Gyamerah said the company would be allowed to operate when it pays at least 40 per cent of the liability and also gives a satisfactory arrangement to pay off their balance of 60 per cent.

The liability was a three-year default which included all tax types.

He said the company had up to 30 days to come up with a satisfactory arrangement to pay their liability, and added that refusal to pay the liability would result in auctioning the company to get back the taxes owed.

“You cannot operate in a country and not pay tax, it is not done anywhere”, he said.

The Commissioner said it was important for the finance minister to witness the closure and also see what happens at the grassroots during tax collection.

Amani Linbo Zhu, General Manager for Sol Cement, pleaded with the Authority to allow them to operate to enable them to pay their debts.

Business News of Sunday, 5 November 2023

Source: GNA