Owners of luxury vehicles with engine capacities of 3 litres or more will now pay an annual tax on their vehicles starting August 1, 2018, according to the Ghana Revenue Authority (GRA).

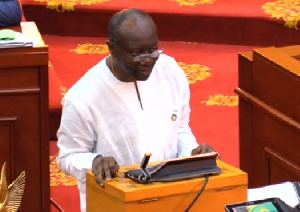

A couple of weeks ago, Finance Minister, Ken Ofori-Atta during the presentation of the Mid-year Budget Review in Parliament, indicated that as part of government’s efforts to bridge the gap in revenue, there is going to be the introduction of luxury vehicle tax.

Vehicles with engine capacities of 3.0 – 3.5 litres will attract an annual tax of 1,000 Ghana cedis; those with engine capacities of 3.6 – 4.0 litres will pay 1,500 cedis annually; while 4.1 litres and above are to pay an annual tax of 2000 Ghana cedis.

Mr Ofori-Atta was quick to add that commercial vehicles will not be included in the levy.

“Commercial vehicles will be exempted from this policy,” he indicated.

Speaking in an exclusive interview with Kwami Sefa Kayi on PeaceFM‘s “Kokrokoo” Show Monday, Commissioner-General of the GRA, Emmanuel Kofi Nti, disclosed that the DVLA will start collecting the ‘luxury tax’ next month.

“Those already using the vehicles in the country will pay when they are going to renew their roadworthy certificate,” he revealed.

Business News of Monday, 30 July 2018

Source: todaygh.com