MTN Ghana paid GH¢5.9 billion in direct and indirect taxes, along with an additional GH¢0.4billion in fees, levies and other payments to government agencies last year.

Together, these payments represents 47.1 percent of MTN’s total revenue paid to the government for the 2023 financial year.

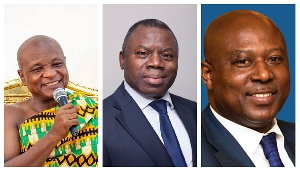

This was revealed by its Board Chairman, Ishmael Yamson, during the company’s annual general meeting (AGM) in Accra. He reaffirmed MTN Ghana’s dedication to maintaining its role as a development partner to the government by contributing to the fiscal and socio-economic advancement of the country.

Updating shareholders on the company’s performance for the year 2023, Mr. Yamson highlighted that MTN successfully navigated challenges in the business environment to achieve notable success during the period.

He attributed this success to the company’s ongoing commitment to disciplined execution of its strategic objectives.

“In the past year, the Ghanaian economy faced several challenges that impacted the business environment. These included elevated inflation and a tight monetary policy which led to an increase in the domestic cost of capital,” he said.

In response to the economic challenges, the government implemented a three-year fiscal adjustment and reform programme, backed by a US$3billion Extended Credit Facility arrangement from the International Monetary Fund (IMF).

As a prerequisite for the IMF programme, the government introduced a Domestic Debt Exchange Programme (DDEP) in a bid to return the country to the path of debt sustainability. The initial phase of the DDEP, primarily involving domestic creditors, led to a decrease in interest income on investments and prolonged the duration needed for bondholders, including financial institutions, to recoup their invested capital in Treasury bonds.

Consequently, this resulted in a rise in the cost of credit, limited access to new capital and impeded the domestic investment environment. The second phase, on the other hand, involving external creditors, has yet to be finalised and put into effect.

“Despite these challenges, I am happy to report that our company has continued to demonstrate discipline in executing on its strategic goals for 2023. This success is a testament to the hard work, dedication and resilience of our employees, as well as the support of our valued partners,” the board chair added.

Providing further insight into the company’s performance in 2023, Chief Executive Officer of MTN Ghana, Selorm Adadevoh, said service revenue experienced a year-on-year (YoY) growth of 34.6 percent, driven by substantial contributions from voice, data and mobile money revenue streams.

“This growth can be attributed to well-executed commercial strategies and our focused investment in maintaining high network quality, expanding coverage and delivering a good experience to our customers, as well as achieving progress in our pricing initiatives across the business,” he reported.

According him, the national SIM re-registration exercise posed a challenge in the company’s subscriber base, resulting in a 6.3 percent YoY decrease.

“Despite the challenges presented and the potential implications on the business, our unwavering commitment to providing high-quality services to attract new customers and retain existing ones helped partially mitigate the full impact of the national SIM re-registration exercise on the business,” he stated.

Financial performance

MTN Ghana’s financial report for 2023 shows a robust performance with a strong total revenue growth of 34.6 percent compared to the previous year.

According to its annual report, the growth was achieved through targeted business strategies that led to an increase in voice, data and mobile money revenues.

As part of the company’s commitment to disciplined execution, the management team executed the expense efficiency programme proactively to control costs, maintain profitability and ensure business growth.

As a result, earnings before interest, taxes, depreciation and amortisation (EBITDA) grew by an outstanding 40.2 percent year-on-vear (YoY), and EBITDA margin also increased by 23 percentage points from 56.1percent in 2022 to 58.4percent, portions of the report read.

Profit after tax also grew by 39.4 percent YoY and earnings per share increased by 29.5 percent YoY.

“These impressive results demonstrate the company’s commitment to driving sustainable business growth in challenging times,” the report further noted.

Business News of Wednesday, 27 March 2024

Source: thebftonline.com