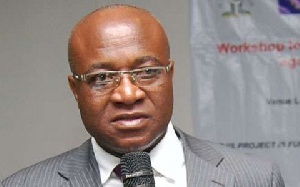

Majority Leader of Parliament, Osei Kyei-Mensah-Bonsu, has urged the 275-member legislature to consider setting up a Committee of Economic Planning to undertake fiscal analysis of loans that are brought before Parliament for approval.

According to Mr. Kyei-Mensah-Bonsu, Parliament is subject to the whims and caprices of the Executive – and loan agreements brought before it are often hastily approved without proper scrutiny.

“We should be cautious and not rush to approve loans that come before us; which is the reason why l insist that the House should have a Committee on Economy. We need a Committee on Economy or Economic Planning, so they do the fiscal analysis on each borrowing that comes to this House. We will then be able to tell the net effect of that borrowing, and it will tell us whether or not we should approve that loan.”

His comments follow Parliament’s adoption of the Annual Public Debt Report for the 2017 Financial Year.

The country’s total debt stock for 2017, both domestic and external stands at GH?142million, according to the Ministry of Finance.

Total external debt service for 2017 amounted to GH?7.5billion compared to an outturn of 6.9billion in 2016, the Public Debt Report for the 2017 Financial Year stated.

The report also indicates that in 2017 government signed 10 loan agreements amounting to US$506.8m. Of this figure, six loans amounting to US$394.6m were borrowed under non-concessional terms while two loan agreements in the sum of US$100m were signed under concessional terms.

Government also contracted two domestic standard loans in the sum of US$12.3m.

Furthermore, the report reveals that interest payments now account for 35% of government revenue and 26% of expenditure. Interest payment is said to now constitute the second-biggest expenditure item after compensation of employees.

It was further explained to the Finance Committee of Parliament that interest payment currently represents 6% of GDP as against an average of 5% in the sub-region.

Out of the total amount of external debt service for 2017, total principal repayment constituted GH?4.8billion – less than the programmed amount of GH?6billion, due mainly to exchange rate effects.

The first Eurobond, which was issued in 2007, was fully paid-off in October 2017.

Business News of Thursday, 7 June 2018

Source: thebftonline.com