There has been a massive shakeup and reshuffle among officials of the Customs Division of the Ghana Revenue Authority (GRA) at the Tema Habour as part of internal measures to ensure the Authority performs at its maximum efficiency.

The shakeup happened on Monday and had some ten top officials being asked to change positions as part of internal periodic transfers aimed to ensure that officials do not overstay at a particular duty post.

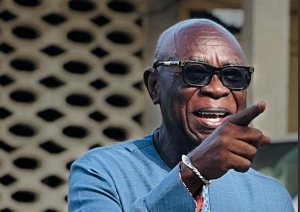

The reshuffle was effected days after the Commissioner General, George Blankson, warned that the GRA would embark on a pragmatic programme to seal leakages in the collection of government revenues at the various ports and points of entry.

“Periodic transfers are part of our normal internal arrangements and the idea is that no official stays at a duty post for more than the required period. There is a possibility that when an officer stays at a particular post for too long, familiarity sets in and it creates the potential for one to get compromised.

“Sadly, anytime there is such transfer and internal reshuffle, top government officials start to lobby and put pressure or even sometimes threats just because the reshuffle list contains one or two of their favorites as if those officials are above the law.

In this particular instance, the pressure from government has not started yet and we believe the GRA would be given the freedom to exercise its mandate without political pressure”, a top Customs official told The New Crusading GUIDE.

The statement issued by the Commissioner-General, George Blankson, noted:

“It has come to the notice of the Customs Division of the Ghana Revenue Authority that some importers, traders, shipping agents and clearing agents are in the habit of falsifying, faking or altering documents covering their consignments of goods imported with the aim of evading the payment of the correct and appropriate duties and taxes.

“These documents include invoices, bills of lading, sales contracts, bank payment documents and even the Customs Classification and Valuation Reports. The conduct constitutes an offence under Section 123 of the Customs Act 2015, (Act 891).”

The statement warned that an officer of the Customs Division found to have condoned and connived to commit any of the offences would be disciplined in accordance with the internal disciplinary procedures and where necessary such officer may also be prosecuted accordingly.

It also cautioned the general public that any importer, trader, shipping agent or clearing agent caught in this practice shall be sanctioned in accordance with section 121 of Act 891 which includes up to a five year jail term.

Business News of Thursday, 9 February 2017

Source: New Crusading Guide

Massive shakeup hits Tema Port

Entertainment