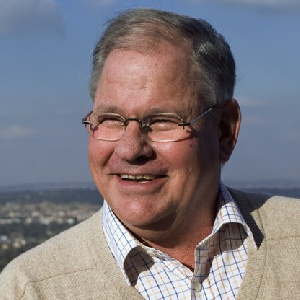

The Board Chairman of FirstRand Bank of South-Africa, Laurie Dippenaar, has said that the business case to acquire Merchant Bank Ghana (MBG) last year was not a good one, as the assessment of returns on the transaction fell short of the bank’s expectations.

The comments of FirstRand’s most influential person come amidst criticism of the bank’s failure to secure acquisition deals in West Africa after courting Merchant Bank Ghana and Sterling Bank of Nigeria for a while.

“FirstRand has been recently criticised in some quarters for failing to complete transactions in Nigeria, Zambia and Ghana.

“We do not see it that way at all, particularly as our strategic preference has always been to grow organically. However, we always consider acquisitions if they make commercial sense -- and in both instances Sterling and MBG did not. This is not “failing”; this is success! This is what management teams must do; deploy capital into assets and activities that will generate a proper return,” he said.

Mr. Dippenaar said this in his statement to the shareholders of FirstRand at the bank’s annual general meeting in Johannesburg last week.

FirstRand, which is currently South-Africa’s biggest bank by earnings and market capitalisation, has targetted the Ghanaian market for a while -- leading to its unsuccessful attempts to buy Merchant Bank Ghana.

Last year, the Bank of Ghana approved the sale of Merchant Bank to private equity firm Fortiz, enabling the indigenous company to acquire 90 percent stake in the bank for GH¢90million after SSNIT -- majority shareholder of Merchant Bank -- rejected an offer from FirstRand Bank.

But the Minority in Parliament objected to the deal, alleging fraud, and called for its abrogation. They questioned the rationale behind rejection of a higher offer made by FirstRand Bank in the value of GH?176.4million for a 75 percent stake.

However, Fortiz maintained that its purchase of Merchant Bank was transparent and that it is determined to turn-around the bank’s fortunes.

With insistent interest in the Ghanaian economy, FirstRand has secured a provisional banking licence from the Bank of Ghana, paving the way for it to begin commercial operations in the country.

FirstRand is expected to set up its first retail business in Ghana early next year, which will bring the number of banks operating in the country to 28.

According to the Chief Executive Officer of FirstRand, Sizwe Nxasana, the decision to open a branch in Ghana forms part of a 10 billion rand (US$920million) programme to expand its operations into other African markets that have prospects for the bank’s growth.

“We have Nigeria that now continues to grow. We have Ghana, where we have a provisional banking licence. We are hoping we are going to be up and running there early next year. Mozambique is doing very well for us. It needs a bit of support,” he said.

Currently, the banking industry in Ghana is considered very competitive, despite about 70% of the estimated 26.5-million Ghana population being unbanked.

In a recent banking survey undertaken by PwC, bank executives noted that existing banks operating in the country would present the most severe threat ahead of any competition from potential new-entrant foreign banks.

Many banks indicated that new entrants to the banking industry will pose less threat to their business as they expect the new ones to be less innovative in their approach.

“Bank executives interviewed are of the view that foreign banks seeking to enter the industry are unlikely to introduce any innovations that will encourage banking beyond the current spheres of the industry’s market; neither are they likely to have significant leverage with the country’s unbanked population,” the report noted.

Click to view details

Business News of Tuesday, 16 September 2014

Source: B&FT