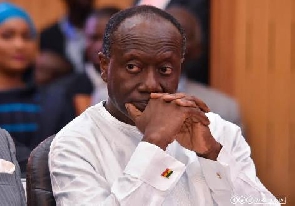

I respect Ghana’s Minister of Finance Ken Ofori-Atta for making the first ever real attempt to catch the happy few rich people in Ghana, but at the same time he still needs to learn a lot about taxation.

Running the economy of a country is not the same as running a private bank Mr. Ofori-Atta, just like running a country is not the same as running a real-estate empire, Mr. Trump.

Taxes in the developed world always serve a double or triple purpose, in Ghana only one is: Creating more income for the state.

Let’s not forget a few basic rules on taxation around the world but especially in a developing nation:

· Taxation should never slow down or disturb economic growth.

· Taxation should always be justified and considered fair by tax payers

· Taxation should have a built-in capacity to pay factor for tax payers

· Taxation should have a purpose other than just collecting money

Last but not least the Taxation authority (GRA) and use of taxes (Government) should be exemplary and show the tax payers that they spent tax revenues carefully and justified.

Taxes paid by a government or governmental body that doesn’t spend tax money wisely is always motivating tax payers not to pay.

A corrupt and vindictive tax collecting authority or un-just taxes will always suffer tax avoidance.

The largest problem of tax collection in a developing economy, in this case Ghana, is to broaden the number of tax payers, called mostly: widening the tax net.

Basically in Ghana and around the world the taxes collected are divided in:

Personal taxes: Income tax

Company taxes: Corporate tax

In connection with Income tax we have taxes on salaries which are mostly monthly or periodically paid and consolidated at the annual tax payments on Income tax.

We also have monthly taxation on annual payable corporate taxes. Monthly payment on corporate taxes is in Ghana paid through (a very bureaucratic system) of withholding taxes.

In developed countries Corporate taxes are being paid monthly based upon monthly estimates on the final annual payment.

Except for the bureaucratic withholding system the tax system we have Ghana can be compared to the developed world.

Then we have the most known general tax: Value Added Tax or VAT, in our case in Ghana with an extra levy to support our National Health Insurance policies.

Whereas developed economies are collecting the vast majority of their taxes through Income, Corporate and VAT, developing countries collect the vast majority of their taxes through direct taxation at points of entries of goods, and in some cases also at point of exits.

This is the main reason that many developing/African countries can’t just open their borders for trade because it would result in a giant loss of tax income for the state. That is the reason I always tell people who want to open borders that tax reforms are needed (towards personal and corporate taxation) before opening borders.

Next to this is the instrument of progressive taxation (the more money you make the higher percentage of taxes you pay) as this week proposed by our Minister of Finance.

Most of the other taxes have a specific purpose out of which the most important reasons are either social responsibility of the wealthy people towards the poorer part of citizens of a nation.

Examples of these are: Tax on Dividends, Tax on inheritances, Tax on Gambling, Tax on Donations, Rent Tax.

Taxes for Health reasons: Tax on Alcohol, Tax on Cigarettes, but also these days extra taxes on high sugar content soft drinks and some countries are even developing extra taxes on food products that lead to obesity.

Taxes on environment and Climate reasons: Tax on larger car Engines, Tax on factories that disturb the environment, Taxes on fuels, the less polluting attracts lesser tax.

Taxes to create Jobs: Extra Tax on people’s second job, extra Tax on overtime, Higher Taxes on employees in a certain age group, to stimulate job creation for the youth.

Taxes to create housing: Many European countries add taxes to small families who live in large houses, blocking access for larger families, the same is done when a high income earner lives in a cheap house.

Other Taxes in the more developed world are: Tourist Tax, Tax on signboards on roadsides, Tax on use of pavements, Tax on having a dog, Tax on use of sewers.

Most of these different taxes have a component of tax credits and penalties so the government is using these taxes trying to influence a “better” or more desired choice of the users/tax payers.

Some of the taxes have multiple tasks, an example is the tax on Real Estate, partly just creating a tax income for the state, also used as extra taxation of the wealthier and lastly the use to regulate access to housing for either the less fortunate or larger families.

In most countries the first needs in life are exempted of taxation or attract lower taxes, for example it’s hard to find any country that puts taxes on drinking water, or basic food and shelter.

However taxes can be put on excess use of water and power to regulate the use of it.

Mostly that reflects in a basic pricing of water, electricity and gas supply and several higher levels for more than normal private use.

Let’s get back to how we got this far: Ghana’s Mid-Year Budget Review Presentation by our Minister of Finance Ken Ofori-Atta.

Although our Minister presented a good initiative to introduce extra taxes on unnecessary large cars, the purpose is only to collect more tax. This has nothing to do with the social aspect of taxing the rich to bring some relieve to the poor, nor does it have anything to do with trying to avoid pollution and saving the planet.

It would be much fairer to tax all cars in a progressive way, after all every cars pollutes and there are many car users who don’t pay taxes at all.

The taxation of high income individuals with a 10% higher than usual income tax rate is the first introduction to wealth distribution through taxation , which could mean an exodus of wealthy people to another country in the developed world. But just like the taxation on bigger cars there is no social justifiable fact behind it, it just serves the purpose of collecting more taxes.

I am not claiming to know the perfect solutions for Ghana, but I miss one of the most important aspects in the Mid-Year Budget Presentation:

What is the Government doing to WIDENING OF THE THE TAX NET?

The last real attempt of a government to do so was the Call Tax under President Kuffuor, since then no other Tax has been introduced to widen the tax net and all the other adjusted and newly introduced taxes are all leading to only extracting more tax from the current tax payers.

I am a great fan of Free Schooling, but people that never paid taxes at least paid school fees, that were a great way of letting non-tax payers pay for a government responsibility.

Now these parents don’t pay school fees and also no tax to the government who is paying the school fees.

Maybe I didn’t read the budget very well but I completely missed tax on real-estate, let’s hope that is only because of the ongoing review on taxation on real-estate ownership.

I consider comments made by the Minister during his presentation to scrutinize foreign companies and put them under forensic audits not appropriate towards foreign investors.

I would expect comments like that from a certain President on the other side of the ocean but not from a well educated, soft spoken and polite Minister of Finance in Ghana.

I can safely state that almost all solid European and American companies in Ghana are better and more serious tax payers than the vast majority of Ghanaian companies. Maybe the Minister is trying to avoid calling certain individuals from more rogue investor countries, but by trying to avoid that he is needlessly hurting the solid investors and tax payers.

Last but not least, although I am also affected by the higher taxation measures of the Government I am more than willing to pay them as long as I can see the results in the next two-and-half year.

Nico van Staalduinen

Business News of Tuesday, 24 July 2018

Source: Nico van Staalduinen