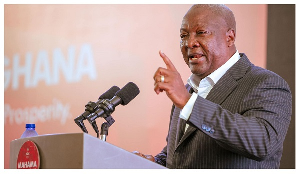

The Chief Executive Officer of The BEIGE Group (TBG), a Financial Services Provider, Mr Mike Nyinaku, has expressed optimism about the future of The BEIGE Group. This follows recent announcements of their expansion into the provision of other financial services including Pensions and Insurance. He said this in an interview he granted to Daily Graphic as they were following up on the current happenings within the firm.

Recounting the history of BEIGE, Mike noted with emphasis that their story so far has not been without challenges but that at every stage, they were resolute in the pursuit and execution of their corporate strategy and this is what has largely accounted for their status as of now.

Mike admitted that there have been some challenges since the company’s inception. Key among the challenges is customer perception. Banking and Finance is an old age business, he said it’s known to be usually practised by very old and mature people.

“When we started BEIGE, we were fairly young and it was difficult to get people persuaded that boys as young as us, could be trusted with people’s hard earned funds. We did not have any long history of work experience in banking nor had we inherited some huge capital to show. Hence inducing confidence in the customer was a herculean task. It was a difficult thing to get customers to believe in us. Even competition wrote us off as they felt we did not have what it takes to run such a business.”

Besides preying on our staff sometimes, competition did not leave us alone. Somehow there seemed to be an orchestrated attempt to either spread false information about us in the industry.

Luckily we did not get derailed by that at all and I’m glad we remained focused because even in these times of triumph, there are still little flushes of that in the environment.

Again, we had a major challenge with people. We did not have the muscle to afford very experienced talents and even where we bent backwards to have them we so easily lost them to competition.

Still with the people issue was the difficulty in finding persons with integrity or persons who were not self-seeking. That was and continuous to be a real challenge.

Furthermore, there was also the issue of the status of regulation at the time. Mike stressed that when they started BEIGE, The Bank of Ghana at the time had not introduced the law that regulates the operation of Microfinance institutions.

Therefore, in order for them to be able to raise or accept deposits from people, they had to find a way to operate two distinct institutions without falling foul of the law nor confusing the customer. The BoG later on saw the need to harmonise regulation such that both functions could be performed by one institution. Mike confirmed that the regulator has provided a lot of guidance to them throughout each stage of the business.

"I hold strongly the view that regulation must be dynamic and without a doubt the BoG has demonstrated so to us. “In this fast changing world, the rules must not and cannot be cast in stone. Technology, competition and entrepreneurship have so much changed how things happen that you cannot be stuck in your ways.

The customer has so much choice now that if you do not evolve to satisfy them you would lose out. Back in the day, customers journeyed to the bank. A few years ago we started taking the bank to the people and now we have even moved further to avail the bank to them on their phones. You sit on the fence and see.”

Most of the regulation in our industry is designed with an intention to minimise risk and protect depositors’ funds and these were introduced at a time when there was absolutely no competition.

Thus some of the guidelines could not take account of the impact of a changing world on business processes. I believe that it would be a positive catalyst to business development and by extension national development if all our regulators would keep an open mind to changes happening in the business environment and their impact on how service practitioners deliver their services.

Despite these challenges, The BEIGE CEO said they have survived mainly because they knew what they were about. “When we started BEIGE, we had a clear strategic intent. Our goal was to build within 10years a platform for the delivery of a broad range of financial services.

These include Banking, Pensions, Insurance and variety of Investment services. Distribution was critical to the success of our model so we intentionally rolled out our service lines in reverse order or using what theorists call a backward integration approach.

The Bank or BEIGE Capital Savings and Loans for that matter was going to serve as the distribution channel and that’s the reason we rolled it out first.”

I would be quick to confess, looking at how everything has unfolded that God has been good to us. The model has worked and surprisingly we are on schedule. With about 2,000 staff and offices in 7 regions, BCSL has become the preferred bank for the informal sector.

Due mainly to the proximity of our branches to the niche marketing centres, the flexibility of our internal processes the competitiveness of our pricing we are actively modernising and modifying micro-banking.

On the other hand, we have also become a preferred and safe choice for individuals and corporate institutions who want to place funds on short term investments obviously due to growing confidence in our operations. We thank them too.

The state of investments we have made so far in infrastructure, technology and talent development would suffice even if the volume of our business increases by five-fold.

Riding on the success of BCSL, we are happy to announce to our valued clients that the BEIGE they know has transformed significantly. BEIGE is now a complete financial services supermarket.

The BEIGE Group, through its subsidiaries now offers services in Banking, Pensions, Insurance and Investments. In Q1 next year we would fully outdoor our pensions arm.

Together with its subsidiaries and affiliates, TBG is providing direct employment to about 4,000 people and serving a clientele base in excess of 600,000 clients.

Business News of Wednesday, 30 November 2016

Source: BEIGE Group