The insurance sector should partner the Government to provide financial support to Small and Medium Scale Enterprises (SMEs) at reduced costs to enhance job creation and sustained national development.

Dr Rashid Pelpuo, a Minister of State at the Office of the President in-Charge of Private Sector Development and Public Private Partnership, said their support could be in loans or insurance underwritings, which the SMEs could use as financial guarantees for loans from banking institutions.

The Minister, who was addressing a meeting of some strategic group members of the insurance sector, on Monday, said securing affordable funding remained a key constraint against SMEs.

He said the challenges in accessing capital at competitive costs had proven to be harmful not only to the private sector but to the entire economy.

The situation the SMEs found themselves, he explained, had also affected the country's export performance, competitiveness, employment creation and revenue generation.

“The high interest rates are adversely affecting the SME sector, and there is no gainsaying that more has to be done to aid our SMEs,” he said.

However, Dr Pelpuo stated that the SMEs were crucial to the Government’s transformation and growth agenda.

He, therefore, reiterated the Government’s commitment to creating the enabling environment to build their capacities and encourage strong private sector involvement to make the economy more resilient for national development.

Ghana, he said, could only succeed in her economic transformation agenda and create the needed jobs if SMEs developed and succeeded.

Dr Pelpuo said the meeting with the strategic group, which included insurance companies and brokers, was part of the preparations for the up-coming SME Financing Fair.

The meeting was also aimed at throwing more light on the essence of the fair, which would devote much attention on strategies of finding a lasting solution to the funding challenges faced by SMEs and expose them to current innovative financing mechanisms.

The fair would take place from April 26 to 27, 2016, at the Accra International Conference Centre on the theme: “SME Financing in Ghana-Enhancing Access and Reducing Cost”.

The Fair, he said, would also help to reduce the cost of information irregularity and its associated effects by bringing the banks, Non-banking financial institutions, government agencies and multilateral agencies and SMEs together in order to bridge the financial intermediation gap.

Mr Simon N. K Davor, the Deputy Commissioner of the National Insurance Commission, said the industry ought to be dynamic and observe credible and trustworthy SMEs for support.

He advised them to allow the solvency guidelines of the Commission to guide them in their respective operations.

SIC Life Company Limited and SIC Life Savings and Loans presented cheques for GHC 5000.00 and GHC 7,000.00 respectively, to the Minister, as their contributions towards a fundraising appeal to the support funding of SMEs.

Business News of Tuesday, 12 April 2016

Source: GNA

Minister tasks Insurance Sector to fund SMEs

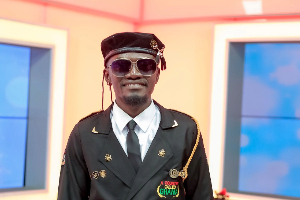

Dr. Rashid Pelpuo

Dr. Rashid Pelpuo