The Minority in Parliament has said claims by Vice President Dr Mahamudu Bawumia that 15 million Ghanaians now have bank accounts, as a result of the mobile money interoperability platform put in place by the government, is not true.

Addressing the youth wing of the governing New Patriotic Party in Accra on Wednesday, 12 August 2020, Dr Bawumia explained that with the triangular feature which mobile money payment interoperability allows; that is the transfer of funds from mobile money accounts to bank accounts and vice-versa, as well as from mobile or bank accounts to biometric payment card accounts (ezwich), it "means that anyone with a mobile account has a bank account. They can make payments out of it and receive interest on their balances.”

The Vice President noted that: “Many people did not and do not understand that we have moved away from the world of branch banking to branchless banking.

You can have your bank account on your phone. You can do banking without visiting a bank branch or signing a cheque.”

He further stated that Ghana is the first and only country in Africa to achieve mobile money interoperability and thanks to that, Ghana is now the fastest-growing mobile money market in Africa.

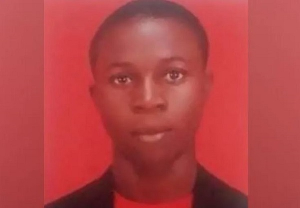

But speaking to the parliamentary press corps, a member of the Communication Committee of Parliament, Mr Sam Nartey George said the claim is not based on data.

According to him, the interoperability platform long existed before Dr Bawumia became Vice President, explaining that what was introduced by the NPP government was just an addition to the existing platform.

He questioned the basis for arriving at the conclusion that 15 million people have bank accounts when a person can have multiple accounts.

“Let us state for the records that mobile money and the whole concept of digital money was introduced eleven years ago in Ghana, in 2009 by MTN. At that time, Dr Bawumia was not vice president, and Dr Bawumia cannot claim that his technological initiatives in digitisation have driven mobile money.

“Dr Bawumia made very erroneous claims; one of such claims was the fact that we now have 15 million people or Ghanaians who have bank accounts. What Dr Bawumia fails to realise is that one individual can have multiple mobile money accounts, so, when he sees 15 million mobile money accounts, it does not mean that 15 million Ghanaians have mobile money accounts.

“Some of you in the media have two or three phones on two or three media networks, and, so, Dr Bawumia is counting you who have two phones and have MoMo on MTN and Vodafone as two individuals. That’s how intelligent the logic of Dr Bawumia is”, Mr Nartey George said.

Click to view details

Business News of Friday, 14 August 2020

Source: classfmonline.com