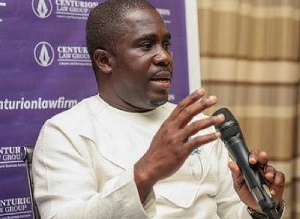

The Chief Finance Officer at Vodafone Ghana, Kenneth Gomado, has dismissed fears that the rate at which Ghana’s mobile money sector is growing is a threat to indigenous banking.

According to him, banks were not very receptive to the Bank of Ghana’s new E-Money Issuers Guidelines and Agent Guidelines.

“The response from banks after the Bank of Ghana decided to revise the regulation to speed up the growth of the service in the country could have been more forward looking,” Gomado noted at the 14th Ghana Banking Awards.

He opined some Ghanaian banks are worried over the prospects of Mobile Money Transfer operated by telecommunication companies.

“The relationships between banks and telcos today can best be described as forced marriage,” he said, adding, “banks know and understand that telcos have developed a service that understandably they feel has the potential of turning telcos into pseudo banks who perform functions that until now have remained their exclusive.”

He explained: “There is little if any evidence from around the world to support it. In so far as banks and telcos are concerned on this matter they are complementary not competitive. Where ever mobile money has been introduced banks have continued to flourish and even grow as a result of the expansion of the unbanked population.”

According to statistics from the Central Bank, mobile money transfer transactions have grown from 30 million in 2012 to 106 million by December 2014. The emerging sector is also said to have employed about 20,000 people nationwide.

Gomado wants the banks to be more receptive to the growth of the mobile money transfer to help accelerate economic growth.

“Mobile Money is not here to take away from the pie of the banks, mobile money is here to create and enlarge the pie,” he stressed.

Business News of Wednesday, 2 September 2015

Source: starrfmonline.com

'Mobile Money can’t kill banking in Ghana'

Entertainment