The Majority in Parliament yesterday rushed through an emergency Energy Sector Levy Bill (2015) that will impose more taxes on petroleum products after it was introduced in the House on Monday, December 21 by the Finance Minister.

The new levies, which take immediate effect, were strongly opposed by the Minority members who argued that they would impose more hardship on the already suffering Ghanaian.

The Road Fund component of the price build-up is now GHc0.40 per litre from the previous GHc0.07 per litre.

Also, there is a tax of GHc0.05 on diesel and LPG as PSM; GHc0.28 on petrol, diesel and LPG as PIS levy; GH¢0.05 on petrol as PSM; GHc0.05 on petrol as recovery margin, GHc0.05 on petrol, diesel and GHc0.23/kg on LPG as forex under recovery and UPPF at GH¢0.09 per litre.

According to the Finance Minister, the urgent bill is to restructure, re-nationalize and consolidate energy sector levies to promote the prudent and efficient utilization of proceeds derived from the levies to facilitate sustainable long-term investments in the energy sector.

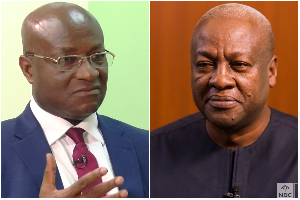

Minority leader, Osei Kyei-Mensah-Bonsu said the entire bill was vague, adding that Mr Terpker did not give specific reasons for the imposition of the taxes.

Making reference to government’s claims that it had paid off the Tema Oil Refinery (TOR) debt, he questioned why another tax was being introduced to pay off the same TOR debt.

“This whole bill has not been explained well to us and that the government is forcing it through just to impose more hardship on Ghanaians,” he said.

The New Patriotic Party (NPP) Member of Parliament for Tema East, Titus Glover, for his part, did not understand why the government was rushing to pass the bill just to impose more economic hardship on Ghanaians weeks after it announced increases in utility tariffs.

“This government is insensitive and does not feel for Ghanaians.”

The NPP Member of Parliament for Kwadaso, Dr Owusu Afriyie Akoto told BUSINESS GUIDE that the government had emptied its coffers through careless expenditure and was just scrapping the barrel to balance the books.

“These new taxes will definitely result in higher inflation, high cost of goods, high interests and high cost of living which bring untold hardship to Ghanaians,” Dr Afriyie Akoto said.

The Majority also used its numbers to approve the new $1 billion Eurobond, which generated a lot of controversy on Tuesday when the minority voted against it.

The speaker said the vote was unconstitutional because Parliament did not have the right number of members to take decisions in the House.

Business News of Thursday, 24 December 2015

Source: Daily Guide