The ARB Apex Bank is urging all Rural and Community Banks (RCB’s) that have not met the Bank of Ghana’s minimum capital requirement of Ghc 1million to speed up with their compliance plans.

Currently, 94 out of the 141 RCBs across the country had met the minimum capital base required by the central bank.

Expressing concern for all RCBs to comply and even add more to the regulatory minimum capital, Reuben Adamtey, a director of the Apex bank said complying with the directive will also enable the banks to take advantage of bigger business opportunities in their operations.

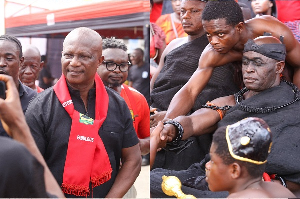

He was speaking on behalf of the Managing Director of ARB Apex Bank, Mr Kojo Mattah at the 30th Annual General meeting of Mumuadu Rural Bank at Osino in the Eastern region.

The Mumuadu Rural Bank last year made a profit before tax of over Ghc2m.

Income surplus account stood at Ghc 2,629,884, giving a total of Ghc 4,741,202.

It approved and paid Ghc 677,457 as dividends while transfer to statutory reserve fund was Ghc 527,469,000.

Addressing shareholders, Reuben Adamtey commended the Mumuadu Rural Bank for exceeding the required minimum capital by almost 300 percent and with an income surplus of Ghc 2.4million, explaining, it was obvious the bank was well prepared for future challenges.

The Bank's total assets increased from Ghc 48,277,466.00 in 2016 to Ghc 63,388,551.00 in 2017 representing a 31.30percent growth.

Stated capital stood at Ghc 1m leaving a balance to be carried forward on income surplus account of Ghc 2,430,782.

While enumerating the success chalked, Adom Asomaning board chairman of Mumuadu rural bank commended shareholders for their immense contribution and the faith they have kept with the bank.

Business News of Wednesday, 15 August 2018

Source: Kofi Siaw

Mumuadu AGM: Apex Bank urges rural banks to meet BoG's capital requirement

Apex bank urges rural banks to meet BoG's capital requirement

0 seconds of 1 minute, 35 secondsVolume 90%

Press shift question mark to access a list of keyboard shortcuts

Keyboard Shortcuts

Shortcuts Open/Close/ or ?

Play/PauseSPACE

Increase Volume↑

Decrease Volume↓

Seek Forward→

Seek Backward←

Captions On/Offc

Fullscreen/Exit Fullscreenf

Mute/Unmutem

Decrease Caption Size-

Increase Caption Size+ or =

Seek %0-9