The National Insurance Commission (NIC) together with the Motor Traffic and Transport Department (MTTD) of the Ghana Police Service, will soon commence a nationwide exercise aimed at enforcing the Motor Insurance Database (MID) introduced by the NIC in January, 2020.

The objective of the joint task force is to clamp down on patrons and dealers of fake motor insurance, in a bid to reduce the number of uninsured vehicles on our roads, while protecting the interest of policyholders and the general public.

Motorists are therefore advised to ensure they have valid motor insurances in order to avoid a brush with the Law. Already, some unscrupulous persons allegedly dealing in fake insurance stickers are currently facing prosecution.

Training of Police MTTD Personnel

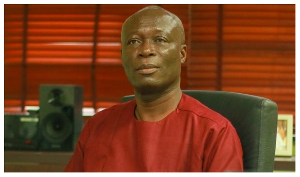

According to Mr Justice Yaw Ofori, Commissioner of Insurance, the Commission had completed a nationwide Training of Trainers (ToT) programme on the MID for some 400 personnel of the MTTD. The MID, he stated, comes with electronic stickers with QR Codes and other security features, and makes it possible for the purchasers of motor insurance to receive real time SMS, confirming the authenticity of their motor insurance policy.

Similarly, Motorists as well as the general public, are also able to utilize a short code (*920*57#) to authenticate the validity of their insurance policies. Mr. Ofori further stated that about 1,000 Gota phones (hand-held devices) are currently being configured with the necessary security features to aid the police in detecting the validity of motor insurance policies.

MID Performance and Challenges

On the performance of the MID, Mr Ofori stated that the system has recorded over 554,000 electronic stickers, so far, indicating the growing confidence in the system, as most Motorists now buy valid insurances with approved entities. All old policies issued prior to January 20, 2020, have been uploaded onto the database, and their new electronic stickers will be issued upon renewal.

Benefits of the MID

Mr. Ofori noted the benefits of the MID to motorists, passengers, and the economy of Ghana would include facilitating the authentication of the insurance of vehicles plying the country’s roads thereby securing the protection of policyholders, motorists, road users as well as other third parties who may suffer from the negligence of motorists. The MID would also curb the activities of fake motor insurance dealers in the system and make insurance companies more financially solid and liquid in order to pay genuine claims promptly and adequately.

MID and ‘Okada’ business

On the heels of a recently issued statement by the Commission to regulated insurance entities not to insure motor cycles and tricycles used to carry fare-paying passengers, Mr Ofori stated that the Laws of the country do not permit the carriage of fare-paying passengers by these cycles. “We have to abide by the Law as clearly stipulated in Regulation 128 of the Road Traffic Regulations, 2012 (Legislative Instrument 2180),” he cautioned.

Advice to the Public

Mr. Ofori admonished, particularly passengers, to ensure that before they board any commercial vehicle or accept lifts from anybody, they should check if the vehicle in question has valid insurance by dialling the MID short code *920*57#, to ensure they are adequately secured.

Business News of Thursday, 13 August 2020

Source: thefinderonline.com