NSIA Insurance at the launch of its new office at Lapaz, in Accra out-doored a new product named APAKAN.

Apakan, a digitally supported payment system product, tailored motor insurance especially for Taxi and commercial drivers was unveiled to the surprise of the public. Apakan is an innovative product which pre-finances the motor insurance cost and affords car owners the flexibility to pay off within 12 months.

According to Aaron Packeys, General Manager-Finance, Apakan gives the insured an opportunity to pay their auto insurance in weekly installments.

“If you pay your weekly insurance installment consistently for 3months, NSIA will go ahead and provide your annual insurance for you while you take your time to pay the rest. This means that you don’t actually take bulk money to buy insurance.”

The easy part is that, drivers and car owners can register with any NSIA –Apakan agent or call free on 1850 for subscription and enquiries.

NSIA Insurance Ghana aims at making insurance easy and attractive through the delivery of hassle-free insurance products and services and with its commitment to contribute significantly to increasing insurance penetration in Ghana; there couldn't have been a better opportune occasion and location to launch the product.

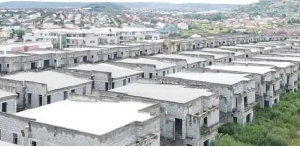

The location of the new office is in the bid to bring insurance to the doorsteps of residents of Lapaz and its environs which has a hub of commercial drivers, SMEs and individuals.

Speaking at the opening ceremony, Mrs. Mabel Nana Nyarkoa Porbley, the Managing Director of NSIA Insurance said NSIA is resolute in its commitment to making insurance easy and convenient to its clients.

“Every insurance company is assessed by how viable they are,” she said.

“Currently NSIA Insurance has more than 700% solvency rate and that goes a long way to determine how quickly you are able to pay claims. This means that you should not be scared to insure with us. We have the capacity to carry your risk and will be able to pay your claims within your shortest possible time.”

She also disclosed that NSIA Ghana has been highly capitalized to far exceed the regulatory requirement of GHC 15m, making the company more than capable of managing all risks portfolios in Ghana.

Business News of Wednesday, 19 April 2017

Source: www.ghanaweb.com

NSIA Insurance Ghana launches 'APAKAN', opens new office

Mabel Nana Nyarkoa Porbley, the Managing Director of NSIA Insurance speaking at the opening ceremony

Mabel Nana Nyarkoa Porbley, the Managing Director of NSIA Insurance speaking at the opening ceremony