The Ministry of Finance in collaboration with the financial services industry, on Tuesday launched the fourth national financial literacy week in Accra to improve outreach for the full range of financial services to the population.

The week on the theme: “Financial Literacy: Key to a Secured Future,” has the primary rational to follow through existing policy priorities to enhance access to financial services, which, has remained low for years, to the population.

The theme also provides the opportunity to reinvigorate the financial aspirations of the population especially the youth, with messages from the various subsectors expected to provide practical steps that could make a secured future a reality.

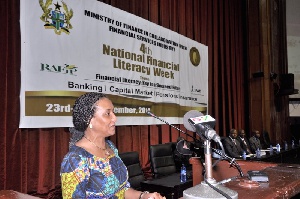

Mrs Mona Helen Quartey, a Deputy Minister of Finance, who launched the programme, said government policy direction is to develop a national literacy strategy that would ensure that consumers are well informed and capable of making sound financial decisions.

This, she said, would also ensure sustainability of financial literacy and coordinate financial education provision, extend outreach and limit costs and duplication.

She said financial literacy has been identified globally as a critical tool for development, in that issues relating to budgeting, savings, investment and the management of risks are relevant for the individual, households and businesses in their development process.

When individuals and households are financially secured they face less risk and ultimately constitute the backbone of the economy, she said.

According to her the “milestone decisions we make throughout our lives ultimately affect our financial security and the financial security of our domestic economy.”

She said making decisions on these issues depending on the level of complexity, requires at least basic financial literacy levels, which involves the ability of the financial consumer to appreciate the essential and basic knowledge that would help make sound financial decisions and judgments.

Financial literacy therefore sets the stage for positive actions such as careful consideration of costs of financial products and services, avoidance of scams and fraudulent schemes, knowledge and understanding of financial products and services as well as savings for the rainy day and for retirement.

Mrs Quartey indicated that since the financial health of individuals and households contributes to the economy and acts as building blocks, it is certain that individuals and households spending, saving and investment would also significantly impact economic growth.

The review of the Social Studies, Management in Living and Business Management syllabus of Senior High Schools to include financial education is to generate interest and better attitude towards savings and investment at an early age.

Major Mahama S. Tara, Chief Director of the Ministry of Finance, said the choice of this year’s theme was based on the fact that there is the need for collaboration with stakeholders to sustain the gains of the previous years’ financial literacy campaign.

Click to view details

Business News of Thursday, 25 September 2014

Source: GNA